Tesla inventory (Nasdaq: TSLA) rose yet again to new heights after a meteoric $100 per share surge at the start of the week and final at $887 in the end of the trading day on Tuesday. The new record sets Tesla’s market capitalization at $159 billion, thereby taking Tesla CEO Elon Musk one step closer to the next tranche in his enormous multi-billion payout package passed in 2018.

If Musk is able to keep a 150 billion typical market capitalization for all trading days from the trailing six calendar month period or 30 calendar day period, he’ll have cleared the market capitalization landmark in his shareholder-approved payment plan. He must meet with specific targets to unlock the next tranche of twelvemonths. Musk passed the first market value landmark before this month after Tesla broke the $100 million barrier. Every time Musk unlocks among those 12 tranches in his 10-year payment plan, he moves yet another step closer to unlocking 20 million stock choices.

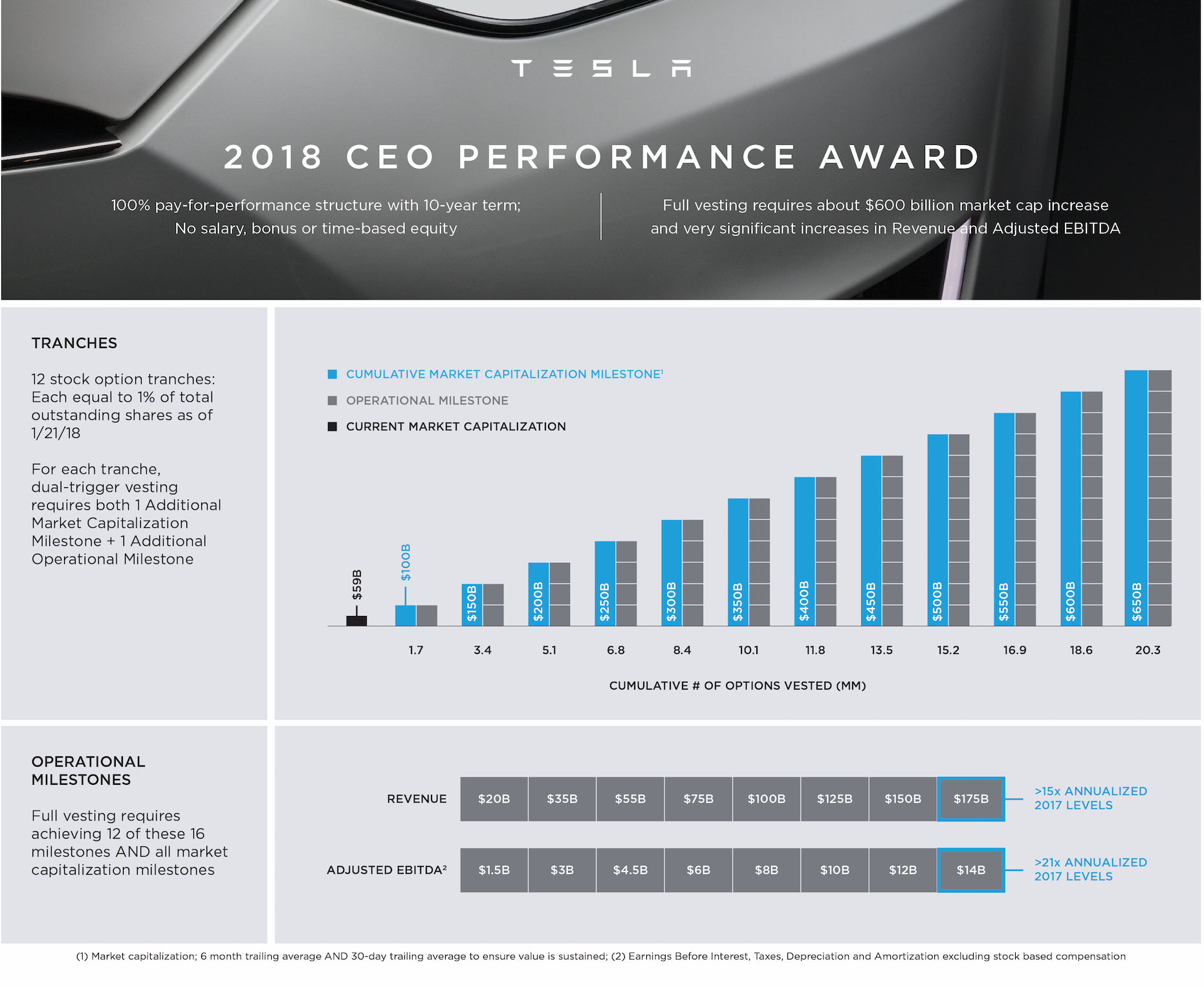

The Tesla main doesn’t have a salary. Instead, he is on a 10-year performance package that includes stock options that vest only if he succeeds in fulfilling specific market capitalization and operational landmarks. It’s a high-risk plan however it’therefore made to make sure Musk executes. It’s additionally bound to ring massive rewards for the car titan, since he can stand to gain Tesla stocks. In the time investors approved the payment plan in 2018, the package was worth $2.6 billion.

(adsbygoogle = window.adsbygoogle || []).push({});

Musk’s performance package is patterned tightly to a comparable 5-year payment plan accepted for him personally in 2012. The package is made up of 12 tranches, with each tranche requiring Musk to fulfill with an landmark along with a market capitalization. For every tranche, Musk has the option to vest in shares that correspond to 1% of Tesla’s overall outstanding shares at the time that the plan was approved.

The first tranche is unlocked once Tesla accomplishes a operational objective and strikes $100 billion in market capitalization. Each succeeding tranche must see Tesla adding an additional $50 billion into its market value along with an operational target. The ultimate objective is to reach a total of $650 billion in market capitalization in a decade, which will place Tesla someplace around the league of Apple and Google, which are valued at $1.4 billion and $996 billion respectively.

Tesla is now valued past $150 billion, which puts it ahead of the Big Three automobile companies in the US. Its current market value is higher than General Motors ($49 billion), Ford ($36 billion), and Fiat Chrysler Automobiles ($18 billion) combined. If Tesla continues to determine more of its financial gains, it may not take long before it overtakes Toyota, that is currently valued as the vehicle company on the planet.

The latest increase comes after a second enormous surge in stock prices following Tesla partner Panasonic reported gains for the first quarter because of its partnership with Giga Nevada. The Japanese battery manufacturer declared that Tesla ramping up production of its vehicles has allowed Panasonic to push costs and erase losses. Tesla inventory rose by over 20 percent and finished the day at $780 after Panasonic&rsquoearnings report.

The article Elon Musk unlocks 2nd mega-bonus landmark after Tesla soars to $159 billion appeared first on TESLARATI.

Article Source and Credit teslarati.com https://www.teslarati.com/elon-musk-unlocks-2nd-mega-bonus-milestone-after-tesla-soars-to-159-billion/ Buy Tickets for every event – Sports, Concerts, Festivals and more buytickets.com

Leave a Reply

You must be logged in to post a comment.