What is Portfolio Churning?

Portfolio churning identifies the fluctuations investors make to their portfolio, keeping in view the market requirements. It has buying and selling the holdings and deciding to keep hauling the investment to provide a greater yield.

The churn mainly is based on the market’s view as a whole or view of their inherent business soon and for your long term.

As an investor, then you invest in a business with a particular view of the marketplace. We’re assuming each of the companies we invest in pass the investment checklist, business checklist, and fundamental analysis.

Still, you are going to want to move your investment according to your upcoming prognosis.

Page Vs Marico Example

Allow me to share the example to make things more straightforward. Again, this helps you understand that the churning process on the marketplace, and neither of the inventory is a recommendation.

Pages Industries and Marico both will pass all of the checklist for investment. Valuation wise both would be overpriced, however, we cannot place the cost to it to our sake of comprehension.

When both firms are fantastic companies to invest in, I made a decision to invest in Marico over Page Industries amid the Corona pandemic. My comprehension of the situation was that individuals would consume more cooking oil than innerwear or swimwear.

The lockdown is opening up, and things are still changing. People in the lockdown are wearing their pyjamas longer, so they buy more of Jockey than Saffola.

So when my worldview towards those business has changed, I could emphasise my investment towards these companies. Again, I am not adding over Page Industries, however this is just an example that will assist you know Portfolio Churn.

Amara Raja

The afternoon Tesla entered India, I was sure to move out of my investment in Amara Raja Batteries.

I believed every car demands a lead-acid battery since the battery pack in the electric vehicles will replace the fuel tank. So, to start the vehicle, they will still need a lead-acid battery.

Still, each Tesla automobile includes a battery that is secondhand. But they’re working on replacing the lead-acid batteries too.

My view has changed, and I like to steer clear of companies and industries that are going to be interrupted if they neglect ’t reinvent themselves.

Portfolio Turnover Vs Portfolio Churning

Portfolio turnover is because of its mutual funds, whereas human investors turnover in the portfolio is termed as portfolio whines.

But both mean the same.

Portfolio turnover is reflected in the percentage term, the frequency at which a fund’s holding is bought or sold. The turnover percentage is your entire asset under management that’s been bought or sold from the past calendar year.

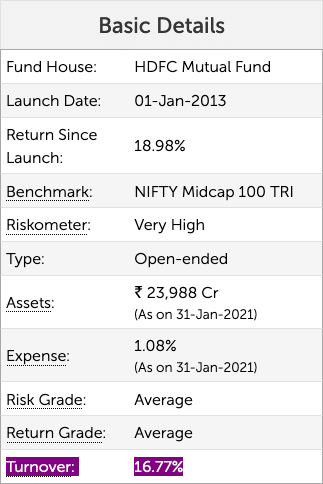

According to ValueResearchOnline, the HDFC Mid-Cap Opportunities Fund includes a turnover of ~16 percent, which means they’ve purchased or marketed 16 percent of their entire advantage in the past calendar year.

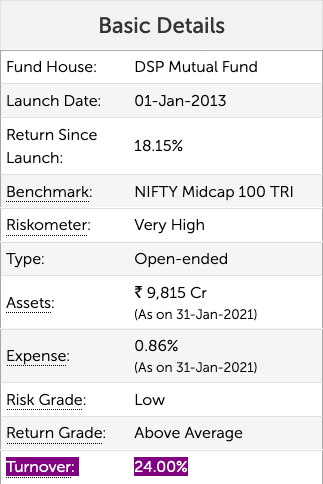

Similarly, that the DSP Midcap Fund includes a turnover ratio of 24%.

The turnover rate is essential for prospective investors to take into account, as financing using a high speed will also have greater prices to represent the turnover expenses. But if the turnover is large, it also means that the fund is active in moving to high performing stocks and sectors.

Portfolio Churn Can Mean Short-Term Thinking

If you start to churn your portfolio, then you can fall in the snare of short-term believing.

In the first 60 days of 2021, I had among my very important churn to my portfolio. The worst portion of it would be to fall in the trap of believing in terms of quarters and months, not years centuries.

Assuming Marico and Page both are terrific companies and will succeed in the next decade, but one may succeed in some years, and many others will succeed in others.

But it doesn’t believe I have been believing short-term just. I also believed that a business where I am spent might be more subject to being disrupted as well. Time will tell how the company re-invents itself, however I may prefer to not select the chance of assuming they’ll make the ideal decisions later on.

However , if you are churning the portfolio a bit too much, then beware. Have you been currently thinking a bit too far for the next few quarters than the next few years?

If you follow any business news station, you’ll be tempted to invest in the metal and cement sector for certain, and if you churn the portfolio based on the news station, you are thinking short term for certain.

Last Thoughts

Purchase and sell if you feel you need to according to your perspective of the marketplace, business, and the company’s inherent business.

Avoid unnecessary churn since it can mean that you end up paying a lot of transaction fees and taxes.

Steer clear of short-term view and maintain the marketplace using a long-term perspective for the small business. Let the team you have spent in build wealth for you.

Article Source and Credit shabbir.in https://shabbir.in/portfolio-churning/ Buy Tickets for every event – Sports, Concerts, Festivals and more buytickets.com

Leave a Reply

You must be logged in to post a comment.