SpaceX President Gwynne Shotwell says that the Starlink satellite online firm is in no hurry to develop into another company and pursue an IPO, and that demeanor must terrify competitor constellations and ISPs such as OneWeb and Comcast.

Founded in January 2015, SpaceX has been growing a enormous constellation of satellites capable of providing high-quality broadband net anyplace on Earth for half a decade. Called Starlink, SpaceX established its first recorded satellite prototypes – known as Tintin A and B – at February 2018, functioning as a successful alpha evaluation for its myriad technologies the firm would have to learn to understand the constellation’s goals. 15 months SpaceX started its first batch of 60 radically-redesigned Starlink satellites – packed flat to match in an unmodified Falcon 9 fairing.

Less than nine months later that initial ‘v0.9’ assignment, SpaceX has finished another three dedicated launches and made Starlink – now some 235 operational satellites strong – the planet ’s largest private satellite constellation with a massive margin. Now only two weeks off from its own Starlink launching, SpaceX’s second-in-command has revealed that the firm will divide Starlink off to its own company, enabling an IPO without forfeiting SpaceX’s liberty. But, Shotwell also made it very clear that SpaceX is in no hurry to do so, and that reality must strike fear into the hearts of Starlink’so lots of opponents.

Scooper duper using @danahull pic.twitter.com/iDm1HdJQwu

— Ashlee Vance (@valleyhack) February 6, 2020

(adsbygoogle = window.adsbygoogle || []).push({});

Bloomberg first broke the news using a snippet revealing that SpaceX COO and President Gwynne Shotwell had told a private investor event that Starlink could IPO as an independent firm. While important, a SpaceX origin – after affirming the information – also told Reuters reporter Joey Roulette that it would be “several years” before the business could kick off the process of some Starlink IPO.

Worth noting that Gwynne Shotwell's remarks about SpaceX contemplating an IPO — something the company has openly dreamt of previously — comes on the exact identical day since OneWeb, Starlink's chief competitor, intends to start its first significant batch of satellites to orbit.

— Joey Roulette (@joroulette) February 6, 2020

While a slice of data at face value, the fact that SpaceX is years off from a possible Starlink IPO implies that the company is confident in which it stands now. Given that SpaceX only began ramping up its own Starlink production rates and start cadence a handful of months back, that confidence – supposing SpaceX’s respected President and COO isn’t lying into the faces of investors – isn’t a small feat.

Thanks to this manufacturing and launching cadence ramp, SpaceX is likely in the middle of one of their very periods its Starlink app will experience. As a private company, SpaceX’s balance sheets are a black box into the public, but it’so safe to state that the it’s going via – or has gone through – a phase of “manufacturing hell” like what Tesla experienced when it began constructing Roadsters, Model S/Xs, and Model 3s.

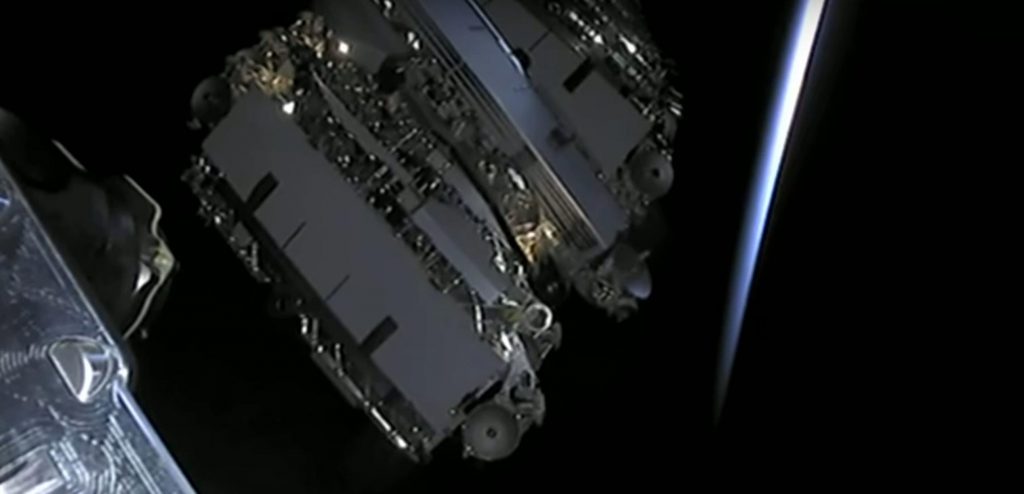

A pile of 60 Starlink v1.0 satellites. (SpaceX)

A pile of 60 Starlink v1.0 satellites. (SpaceX)

Building satellites such as cars

In under 12 months, SpaceX has effectively gone out of producing zero satellites to mass-producing something similar to 2-4 Starlink spacecraft each and every day any documents held at the business. It’s possible that firms such as Planet (now the owner of the second-largest private constellation) or even Spire have assembled more spacecraft in a given time, however, SpaceX’s satellites are at least an order of magnitude larger, on average.

Around 260 kg (570 lb) apiece, SpaceX has assembled and found a total of 240 spacecraft – together weighing more than 60 metric tons (135,000 lb) – in under 2 months. Furthermore, the provider not only plans to crush this ordinary but needs (if not desires ) to do so for many years without interruption.

Starlink v1.0 Launch 1. (SpaceX)

Starlink v1.0 Launch 1. (SpaceX)

Back in May 2019, CEO Elon Musk confidently stated that he considers SpaceX currently has all the funds it requires “to create a operational [Starlink] constellation”, likely referring to at least ~1500 usable communications satellites – slips included. That is the reason the reason opponents ought to be moderately fearful that SpaceX isn’t pushing for an IPO earlier than later. Possibly the single most important reason contemporary businesses pursue IPOs is to raise significant funds – generally far more than could be nearly (or fast ) raised while private when implemented successfully.

A step further, “several yearschanges should be meant by ” for SpaceX’s Starlink constellation if all goes as planned. In 2020, SpaceX has stated that it will attempt as much as 20-24 dedicated Starlink starts, an achievement that could translate strong at the end of the year. SpaceX claims that 24 launches (20 if the initial four missions have been subtracted) is sufficient to offer international coverage and plans to begin serving customers from the northern US and Canada as soon as this summermonths.

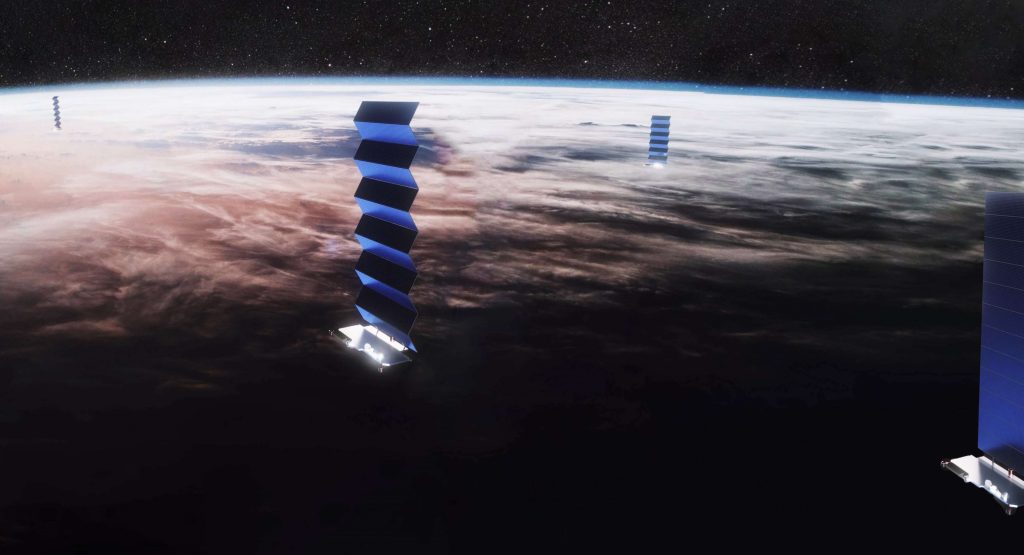

An cartoon of SpaceX’s Starlink satellite constellation. (SpaceX – GIF from Teslarati)

An cartoon of SpaceX’s Starlink satellite constellation. (SpaceX – GIF from Teslarati)

As of now, SpaceX has performed three 60-satellite Starlink starts complete in the previous 3 months – 2 in January 2020 independently – and Starlink V1 L4 (the fourth v1.0 launching and fifth launching entire ) is scheduled to lift off only two weeks from now on February 15th. If Musk and Shotwell are right and SpaceX could start at least one or 2 million satellites without increasing any additional funds, the constellation – possibly reaching those numbers by early to mid-2021 – may already have hundreds of thousands of customers by now more funding is required. 2000 Starlink v1.0 satellites, for reference, would offer adequate collective bandwidth for at least 500,000 users to concurrently stream Netflix content in 1080p.

As early 2019, SpaceX had raised a total sum of $2B in debt, investments, and venture funds. Thus, in the unlikely event that 100 percent of the funding goes to Starlink, the corporation would ultimately have to spend $500-700M yearly from 2018 to the end of 2021 to run that massive pool of funds dry from the time 1000-2000 satellites are in orbit.

SpaceX’s incredibly successful program of reusable rocketry is a base of this firm ’s Starlink constellation and is still just one of the reasons that its apparent cost projections are low enough to defy belief. (Richard Angle)

SpaceX’s incredibly successful program of reusable rocketry is a base of this firm ’s Starlink constellation and is still just one of the reasons that its apparent cost projections are low enough to defy belief. (Richard Angle)

500,000 clients paying $50-100 a month at the end of 2021 would conservatively allow Starlink to generate $300-600M exceeding the possibility of commercial contracts or more profitable government, in revenue. In other words, if SpaceX can accumulate an average of 20,000 paying subscribers each month between now and the end of 2021, Starlink could very well become self-sustaining at its current rate of expansion – or near it – at time SpaceX is damaging for more funds. In an worst-case scenario, it thus appears all but certain that “many years” from now, SpaceX’s Starlink app will have at least a few thousand high-speed satellites in orbit, and a broad network of ground stations, and also a massive swath of alpha or beta clients from the time IPO event begin.

Given that that possible infrastructure would be worth at least $1-2B only out of a capital investment perspective, Starlink’s IPO evaluation – beneath Shotwell’s patient “maybe 1 day” strategy – could be stratospheric.

Check out Teslarati’s newsletters for immediate upgrades, on-the-ground perspectives, and unique glimpses of SpaceX’s rocket launching and recovery processes.

The article SpaceX is in no hurry for a Starlink IPO and that will terrify competitors appeared first on TESLARATI.

Article Source and Credit teslarati.com https://www.teslarati.com/spacex-starlink-ipo-no-rush-competitors-scared/ Buy Tickets for every event – Sports, Concerts, Festivals and more buytickets.com

Leave a Reply

You must be logged in to post a comment.