There are hardly any stocks on the market which inspire such volatility because American electric vehicle manufacturer Tesla (NASDAQ:TSLA). The company has been on a tear lately, propelled by Q4 2019 outcomes and highlighted through an ever-growing number of supporters on the internet. Yet amidst these victories, it appears that Tesla has reached a point where the battle lines are being drawn between the company’s supporters its retail analysts and investors in Wall Street.

Tesla is a catchy company because it covers industries, to evaluate. The electric vehicle maker is the most demanding automaker in the world by market value, although it produces and only creates a small percent of the automobiles each year, which veteran car businesses market. In 2019, Tesla sold just over 367,000 vehicles. Volkswagen, the third-largest automaker in accordance with advertise cap, sold over 6 million components .

However, the Tesla narrative is not about the company’s automobiles. Check out Tesla’s mission demonstrates that the company’s aims are bigger than earning money doing this and just selling cars. Tesla aims to quicken the entire world ’s transition to sustainability, also making electric cars which are better than vehicles is a crucial part of the puzzle. This suggests that there are dimensions to the company that establishes far beyond that of its car business.

Tesla Solar Roof (Source: Tesla)

Tesla Solar Roof (Source: Tesla)

(adsbygoogle = window.adsbygoogle || []).push({});

It is this last point where the divergence is the most evident involving Tesla’s supporters and Wall Street analysts. Tesla investors, a lot of whom own the company’s products, are intimately acquainted with CEO Elon Musk’s plans and intentions, in addition to the scope of the companynumerous enterprise. Very few of those who own a Model 3, as an example, aren’t aware that Tesla also makes roofing tiles, or batteries such as Powerwalls, or batteries such as Megapacks for that matter.

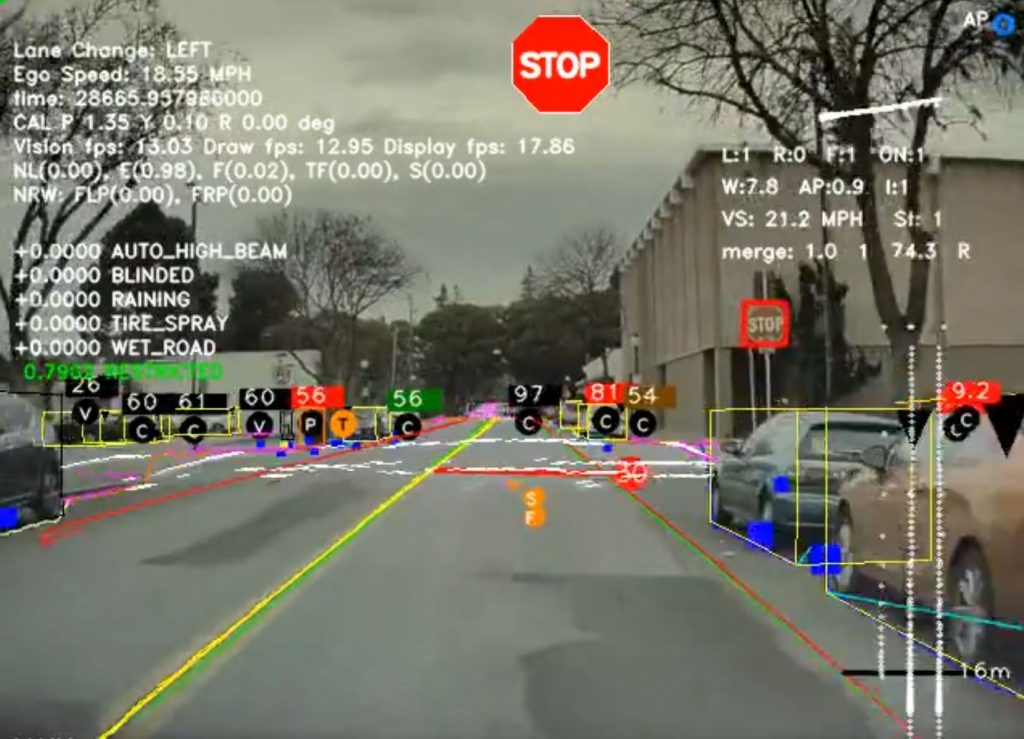

Unfortunately, many of analysts that cover TSLA stock appear to be trapped under the impression that the provider is an automaker, complete stop. Check out analysts and critics that frequent media outlets such as CNBC shows that hardly any really consider the possibility, or even recognize the existence of Tesla Energy, a business that legendary billionaire Ron Baron considers may be just as large as the company’s electric vehicle business. Even fewer admit the value of Tesla’s Autopilot data, that can be gathered from miles.

This might be understood at Wall Street’s quotes on Waymo, a Google-based company aimed at deploying and developing a self-driving service. Morgan Stanley analyst Brian Nowak wrote in a note to clients this past year that the startup is worth $105 billion due to its self-driving technologies, and that’s conservative quote . Before s upgrade, Nowak valued Waymo in a far more optimistic $175 billion. In contrast, Tesla’s valuation, in the last Friday’s near, stood at $134 billion. That sum included its own autonomous tech, its energy company, and the company ’ s automobile industry.

Tesla Autopilot (Source: Elon Musk | Twitter)

Tesla Autopilot (Source: Elon Musk | Twitter)

As is the nature of Tesla stock, the company’s potential is recognized and considered by the company’s supporters in the Street. There is very little possibility that the understanding of Tesla involving its retail supporters and analysts will converge anytime soon. This divergence became a focal point in the company’s recent Q4 2019 earnings call, when Elon Musk confessed that retail investors might have a better grasp of this company’s plans than conventional Wall Street analysts.

“I really do think that lots of investors really have more precise and significantly much deeper insights than a lot of the institutional investors and better comprehension than a lot of the analysts. It feels like if people looked at a few of the smart retail investor analysts and what a few of those smart smaller retail investors called concerning the potential of Tesla, you’d likely get the highest accuracy and remarkable insight from a number of those predictions,” Musk explained.

Tesla will stay a polarizing company for many years to come. That said, Tesla Energy’therefore fall is determined by the market and the company’s Solarglass Roof V3 are being installed to a growing number of houses in the United States. Tesla’s Full Self-Driving method can be currently closing in on being feature-complete. Overall, it appears that it will be a matter of time until the real possibility of Tesla emerges, and as soon as it does, an individual would have to deny a whole lot of their enterprise to consider it as a automaker.

Disclosure: I don’t have any ownership in shares of TSLA and don’t have any plans to initiate some positions over 72 hours.

The post Tesla's battle lines have been drawn with retail investors on one side and Wall St on the other appeared initially on TESLARATI.

Article Source and Credit teslarati.com https://www.teslarati.com/tesla-tsla-battle-lines-retail-investors-vs-wall-street/ Buy Tickets for every event – Sports, Concerts, Festivals and more buytickets.com

Leave a Reply

You must be logged in to post a comment.