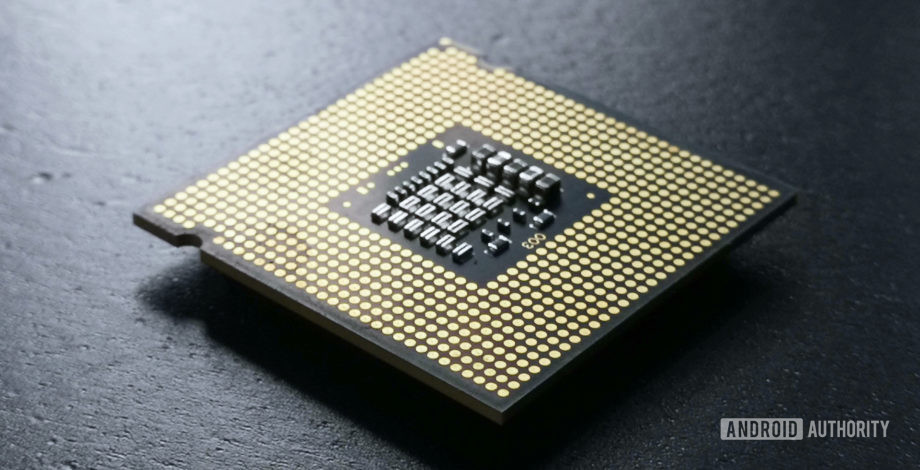

Credit: Robert Triggs / Android Authority

In case you’ve attempted to buy the most recent production of AMD or Nvidia graphics cards, AMD Ryzen chips, or game consoles like the PS5 or Xbox Series X/S, you might have noticed that there’s a bit of a stock catastrophe hitting a few sectors of the consumer tech sector right now.

The main culprit — on top of the impact of the ongoing COVID-19 outbreak — is a international chip shortage that’s severely limiting the availability of the most recent technological products. The shortage of processing components can also be having knock-on effects for other markets, including automotive, cryptocurrency, and now smartphones.

Smartphones seemed to dodge the crunch in overdue 2020 and early 2021, but there are increasing concerns that similar shortages have been still on the road. Back in March 2021, Xiaomi president Wang Xiang implied that a chip shortage is driving up SoC prices and that this may come in more expensive smartphones this season. In exactly the same month, Samsung CEO DJ Koh warned of “a serious imbalance in supply and demand of processors. ”

Luckily, we’re yet to see the exact identical dreaded “from stock” messages for smartphones that now plague computer parts and gambling shops around the world. But the possibility that chip shortages will spread to major handset releases in 2021 is rapidly turning into a reality.

The Wonderful global computer chip shortage: What you need to know

![]()

The current chip shortage is the consequence of a perfect storm of huge demand and limited supply. The unprecedented desire for at-home entertainment in the aftermath of this COVID-19 pandemic has seen stock problems for the hottest consoles and graphics card which have continued far beyond the usual launch window hurry. The necessary change to working from home has also seen notebook growth reach decade highs. At exactly the same time, the boom in the value of cryptocurrencies has reignited mining elevation, piling on demand for assorted high-end processing components.

The chip shortage is the consequence of a perfect storm of huge demand and limited supply.

While consumers may be noticing the chip shortage most significantly when it comes to gadgets, even the roots of this current shortage can be traced back into the automotive sector. In the first stages of the outbreak, automakers drastically reduce demand for chips in expectation of falling sales. This turned out to be premature. Sales rebounded fast, along with the automotive marketplace rushed to purchase back cutting-edge manufacturing capacity. Though most of this had previously been given away to additional processor sectors experiencing their very own need. The end result is two huge markets both needing more processors, but with production capacity already maxed out.

A variety of smaller factors have also contributed to the supply and demand ends of this shortage. February’s electricity outages from cold weather attracted Samsung’s Semiconductor manufacturing operations in Austin Texas into a halt before mid-March. Taiwan can be suffering from a serious drought which threatens the significant semiconductor manufacturing operations in the nation. The US-China commerce war has also seen Chinese businesses, including Huawei, stockpile chipsets and other elements during 2020 and to 2021.

Credit: Qualcomm

There are just a lot of processors to go round

It’s important to be aware that Microsoft, Sony, Nvidia, AMD, Apple, Qualcomm, along with others don’t fabricate their own chips. The majority of the planet ’s cutting-edge semiconductors are produced by Samsung and TSMC. Although output from additional manufacturing operations around the world, for example NXP and Texas Instruments, is also significant and in both short supply. This is very true in regards to automotive components.

The majority of industry need for all sorts of chipsets falls to a small number of foundries.

Chipsets for luxury computing niches are largely vying for 10nm and 7nm production from Samsung and TSMC. Smartphone chipsets use these manufacturing fabs too. Flagship-tier cellular chips are competing with automotive orders on 5nm manufacturing lines from TSMC and to a lesser range in Samsung.

Why not add more power?

Intel is still an outlier. It manufactures its own chips and isn’t experiencing a shortage like rival foundries. The company aims to capitalize on the current shortage by expanding its operations into Arizona and opening its foundries into take orders against third-parties once more. Including chips built on equal Arm and RISC-V architectures. Although this can take months to trickle as the industry familiarizes itself with and evaluates Intel’s instruments and processes.

So, why not raise production to meet demand?

Alas, the problem isn’t so easy. Fabs are complicated funding and time-intensive surgeries that require expensive experience and intellectual property to build. Extending existing production lines may take months, creating new ones in the ground up might take years and cost tens of billions of dollars. Therefore, the Biden management ’s critique into US production can’t aspire to help alleviate the shortage in the short or medium term.

What exactly does the computer chip shortage mean for products?

Credit: Oliver Cragg / Android Authority

We’ve already seen the chip shortage moan in delays, shortages, and cost increases for products across various businesses.

Automakers believed the brunt first, using inadequate chip provides to complete construction vehicles. Research firm IHS Markit (via CNBC) anticipates 672,000 fewer vehicles rolling off production lines in Q1 2021. Big brands including GM, Ford, and Tesla are all affected and will have significantly less stock available for purchase annually. Analyst estimates suggest this could cost the automotive marketplace $60 billion annually. Toyota is weathering the storm much better, as a result of some fourth-month chip stockpile.

In the gambling markets, the most recent PlayStation and Xbox consoles have been consistently in and outside of stock as supply trickles its way into the current marketplace, although this has gradually improved. The situation in the PC world is much worse, with the hottest graphics cards and AMD CPUs virtually unobtainable. There’s little indication of this improving until overdue 2021 or even 2022. Respectable retailers are list PC products well above the Manufacturer’s Suggested Retail Price (MSRP), due to a combination of high component costs, shortages, and also the limit to dividend exceptions in the US.

Products are selling well above MSRP due to a blend of component costs, scalping, and also the limit to dividend exceptions in the US.

Compounding the woes is the scalping scourge. Games games and graphics cards have been the worst hit with the usage of bots to grab up limited stock which is resold with a significant markup. Sony’s PlayStation 5 continues to market on eBay for nearly twice its MSRP, and graphics cards like Nvidia’s RTX 3070 are available for several times the list price or more. Luckily we haven’t seen the exact same profiteering for other gadgets, nevertheless, but it’s a distinct possibility if the shortage tightens.

Renewed profitability in cryptocurrencies is a significant contributor to the need for graphics cards and also subsequent scalping. It has observed Nvidia announce dedicated mining GPUs and simplifying Etherum mining functionality on its new RTX 3060 series. On the other hand, the developing cost and limited availability of hardware is pushing smaller miners from this current marketplace, consolidating the rewards in larger-scale surgeries such as the ones in China. The chip shortage even has consequences for the “democracy” of cryptocurrency mining.

How about smartphones?

Credit: Luke Pollack / Android Authority

With just a handful of smartphones hitting on the industry up to now in 2021it’s harder to judge the chip shortage’s effect on the handset marketplace than it is with all the automotive and gambling markets. However there are already indications that similar shortages may be on the road.

This year’s bleeding-edge 5nm, 7nm, along with 10nm cellular SoCs are competing for space on exactly the same manufacturing lines including automotive, consoles, along with graphics cards. Some accounts have been already pointing towards a shortage of flagship Qualcomm Snapdragon 888 chipsets, which will have a knock-on effect for stock levels. Rumors suggest this might be partially behind Samsung’s decision to bypass 2021’s Galaxy Note launch.

Even though there’s a fair supply of 5nm chips, other components might end up being the supply bottleneck. Audio, electricity, radio-frequency, along with other integrated circuit components from less expensive fabs are still competing for producing time from a huge array of other components. Reports imply that Samsung is fighting with supplies needed for mid- and – non invasive production. Other sources citing Realme (translated), point to out-of-stock radio and power components for their smartphones.

As well as impacting product availability, small component shortages could drive up final product prices. Previously cheap microcontrollers are already selling for multiples in their historic prices and this is probably a similar situation for common components found in smart phones also.

It may take until the end of 2021 for smartphone demand and supply to rebalance. Until thenwe may see limited stock and/or greater costs.

Qualcomm admits that there is a problem with chipset supply. During Qualcomm’s Q2 earnings forecast, CEO-elect Cristiano Amon mentioned that “we’ve observed, probably a shortage across the whole industry. It’s been more wide across the industry, not unique to handsets. ” Amon predicts that the supply and demand imbalance must “normalize towards the next part of 2021 as ability is set in place. ”

Although smartphone makers are, up to now, sticking to their handset release schedules, the supply of chips and other components is inadequate to ramp up worldwide inventory. That is a bigger problem for smaller producers that don’t possess the bargaining capacity of Apple and Samsung. Reading between the lines of Amon’s comments, smartphone starts throughout 2021 will likely be interrupted by supply limitations. Even if demand and supply align by the end of the year, it may take months into 2022 for global inventory levels to capture up.

Manufacturers might end up directing limited supply with much more restrictive regional fires. Higher costs across a few if not all of markets are also a distinct possibility, particularly if element costs rise. Either way, the outlook for global smartphone shipments is primed to be as rugged as graphics cards and consoles around 2021 and maybe well into 2022.

Article Source and Credit androidauthority.com https://www.androidauthority.com/computer-chip-shortage-1212941/ Buy Tickets for every event – Sports, Concerts, Festivals and more buytickets.com

Leave a Reply

You must be logged in to post a comment.