It was a week that Elon Musk will wish to forget: after a chorus of skepticism about Tesla from the same analysts that have been bullish on Musk and the automaker for decades, the Tesla stock bubble is formally bursting, based on Bloomberg.

The week started with Wedbush proclaiming that the business faces a”Kilimanjaro-like uphill climb” to hit its profitability targets for the second half of the year. Analyst Dan Ives also reduced his price target from $275 to $230 and called the organization ‘s current state of affairs a”code red situation”.

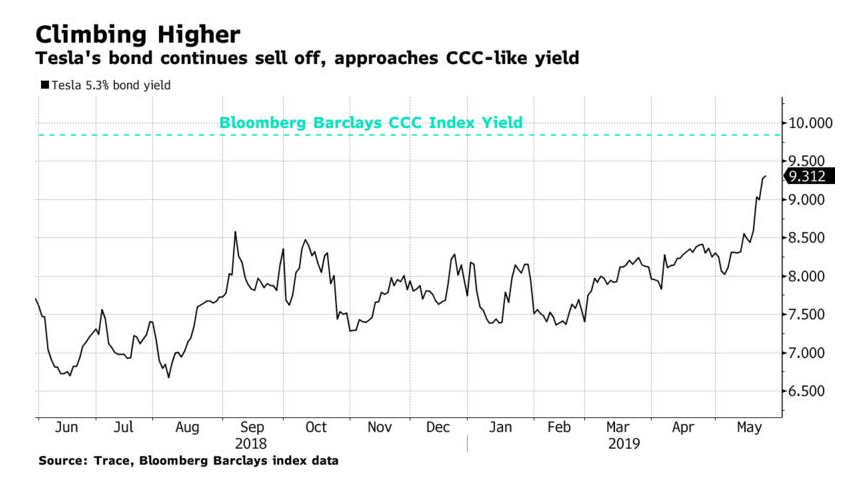

The week then continued with Morgan Stanley analyst Adam Jonas, who’s on a call with shareholders mid-week, stated”supply exceeds demand, they’re burning cash, nobody cares about the Model Y, they raised capital near lows” and there’s been”no strategic buy-in”. Ominously, he added: “Tesla’s is not seen as a growth story, it’s seen as a distressed credit and restructuring story.”

This came after Jonas’ note on Tuesday, which saw the investment bank lower its”bear case” target to on the company to just $10 per share.

Later in the same week, longtime Tesla bull Gene Munster capitulated and issued a stern warning that he believed Tesla will miss its 2019 delivery target range. Munster cited shrinking sales in China and the ongoing trade war as the reason for his increasingly bearish commentary. Munster cut his estimate for Tesla’s full year global car sales by about 10%, to 310,000 vehicles, versus the 360,000 vehicle target that the company put out back in March.

Citigroup and Robert W. Baird analysts also slashed their target prices during the week.

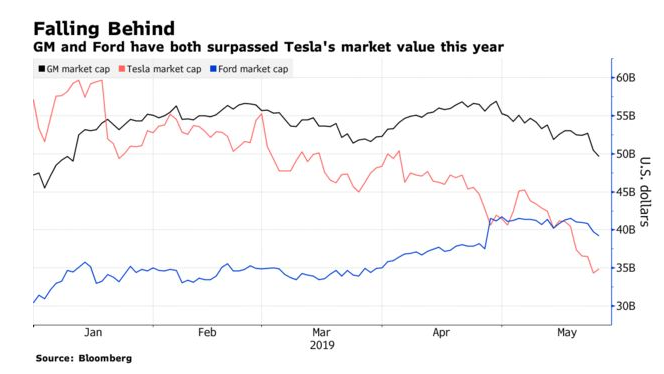

The 10% drop in Tesla’s stock this week leaves it down about 43% for the year, wiping out about $23 billion in shareholder value and putting the company back below GM and Ford in terms of market cap. The company’s 2025 bonds also continued to get crushed, closing the week trading at about 81 cents on the dollar and sporting a nearly 9.3% yield.

The only positives during the week were short lived – namely when the stock tried to bounce on Thursday after a failed pump “leaked” email from Elon Musk stated that the company was conveniently going to have a “record” second quarter. By Friday, that shine had worn off, and the stock had continued its fall.

The timing for Wall Street to lose faith in Tesla is stunning: it’s just five months after many thought the company was going to be able to reach sustainable profitability. Tesla stock had ended 2018 on an upbeat note, soaring on year end sales and production numbers.

Musk’s claim in an e-mail last week that the company risked running out of cash in 10 months without “hardcore” cost cuts didn’t help his cause. It also didn’t help that this narrative starkly stood at odds with what he told people on a call when he was trying to close the company’s recent $2.4 billion financing.

And this came after we reported a former NHTSA head and Consumer Reports both shed continued skepticism on the company’s Autopilot feature, with the former saying it should be recalled and the latter calling it”much less competent than a human”. This likely cast doubt on Musk’s already batshit crazy optimistic prediction of having”a million robotaxis” on the road in coming years.

This week was also preceded by three price cuts on Tesla models over three months, Musk warning that a”difficult” road was ahead and a massive $700 million loss in Q1. In late April, even short-seller Citron Research abandoned his controversial long position in the company.

SCOOP: Andrew Left of Citron Research tells me he is no longer long $TSLA. “I sold after autonomous day,” he said to me. “Elon is the worst communicator. ” He currently has no position, short or long.

— Quoth the Raven (@QTRResearch) April 26, 2019

Barclays analyst Brian Johnson said: “Tesla’s stock for a while was wildly inflated as many investors thought that the company could not only become a very profitable large automaker, but will also dominate other fields like solar energy, energy storage and autonomous mobility. But now the auto part seems to be headed more towards a niche automaker. Those other businesses? Nowhere to be seen. ”

Roth Capital Partners analyst Craig Irwin said:”Investors care more about units, average pricing, gross profit margins and the expectations of gains.”

Bradford Meikle, a senior analyst for Williams Trading concluded: “Electric vehicles are certainly the future of transportation, but I don’t think Tesla will be the one that profits from it. The value of the brand is going down every day. ”

With the”expansion” story today above, until demonstrated otherwise, we look forward to what next week brings.

Buy Tickets for every event – Sports, Concerts, Festivals and more buy tickets

Leave a Reply

You must be logged in to post a comment.