Top news

RBI panel has suggested allowing huge NBFCs with resources above Rs 50,000 Crore to be considered for conversion into banks. The RBI panel recommended letting banking licences for large industrial houses.

Lakshmi Vilas Bank was set under moratorium till 16 December. The withdrawal cap was put at Rs 25,000 such as ECS debits. Further, the bank will probably be merged with DBS bank at the end of moratorium period.

DSP Mutual Fund along with Kotak Mahindra Mutual Fund have launched the NFO for DSP Value Fund along with Kotak ESG Opportunities Fund respectively. The NFOs near 4 December.

Gland Pharma IPO which was oversubscribed two times, debuted with 14 percent premium over issue price of Rs 1500.

JQuery(document).ready(function()

jQuery(‘#sample_slider’).owlCarousel(

objects: 1, 2 smartSpeed: 500,

autoplay: accurate,

autoplayTimeout: 3500,

autoplayHoverPause: accurate,

smartSpeed: 500,

fluidSpeed: 500,

autoplaySpeed: 500,

navSpeed: 500,

dotsSpeed: 500,

loop: true,

nav: true,

navText: [“,”],

examples: authentic,

responsiveRefreshRate: 200,

slideBy: 1,

mergeFit: authentic,

autoHeight: authentic,

mouseDrag: authentic,

touchDrag: true

);

jQuery(‘#sample_slider’).css(‘visibility’,’visible’);

sa_resize_sample_slider();

window.addEventListener(‘resize’, sa_resize_sample_slider);

serve sa_resize_sample_slider()

var min_height =’20’;

var win_width = jQuery(window).width();

var slider_width = jQuery(‘#sample_slider’).width();

if (win_width < 480)

var slide_width = slider_width / 1;

else if (win_width < 768)

var slide_width = slider_width / 1;

else if (win_width < 980)

var slide_width = slider_width / 1;

else if (win_width < 1200)

var slide_width = slider_width / 1;

else if (win_width < 1500)

var slide_width = slider_width / 1;

else

var slide_width = slider_width / 1;

slide_width = Math.round(slide_width);

var slide_height ='0';

if (min_height =='aspect43')

slide_height = (slide_width / 4) * 3; slide_height = Math.round(slide_height);

else if (min_height =='aspect169')

slide_height = (slide_width / 16) * 9; slide_height = Math.round(slide_height);

else

slide_height = (slide_width / 100) * min_height; slide_height = Math.round(slide_height);

jQuery('#sample_slider .owl-item .sa_hover_container').css('min-height', slide_height+'px');

var owl_goto = jQuery('#sample_slider');

jQuery('.sample_slider_goto1').click(function(event)

owl_goto. Trigger('to.owl. Carousel'( 0);

);

jQuery('.sample_slider_goto2').click(function(event)

owl_goto. Trigger('to.owl.carousel', 1);

);

jQuery('.sample_slider_goto3').click(function(event)

owl_goto. Trigger('to.owl.carousel', 2);

);

jQuery('.sample_slider_goto4').click(function(event)

owl_goto. Trigger('to.owl.carousel', 3);

);

var resize_6299 = jQuery('. owl-carousel');

resize_6299. on('initialized.owl.carousel', function(e)

window.dispatchEvent(new Event('resize'));

);

);

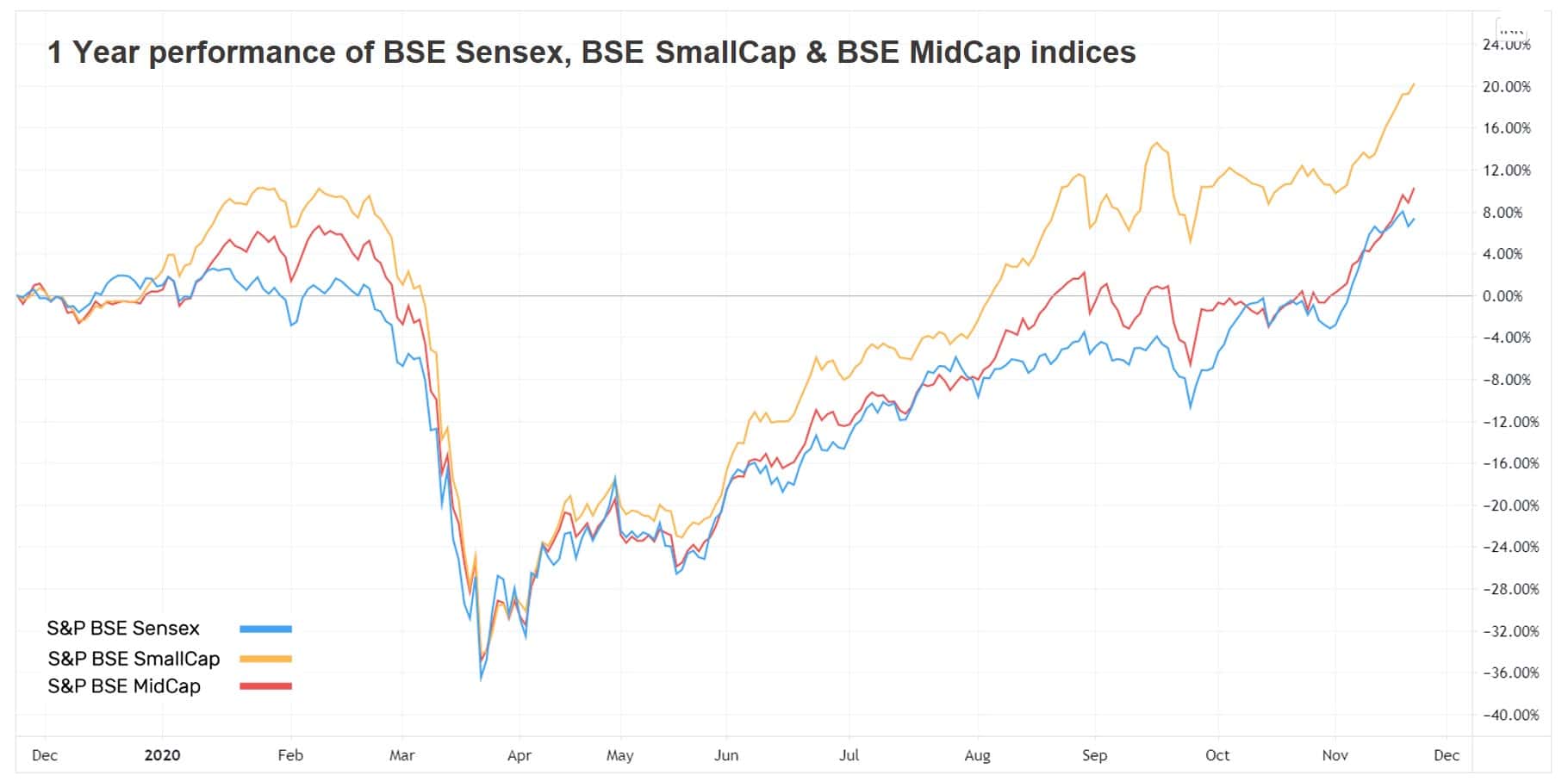

Index Returns

Index1W1Y3YP/EP/B

NIFTY 501.1%7.1%7.7%35.43.6

NIFTY NEXT 502.2%6.0%0.2%37.54.1

S&P BSE SENSEX1.0%7.9%9.6%31.32.9

S&P BSE SmallCap3.5%20.5%-3.0%NA1.5

S&P BSE MidCap3.5%10.5%-0.7%58.92.5

NASDAQ 100-0.3%43.5%23.5%37.27.2

S&P 500-0.8%14.4%11.3%27.73.9

Greatest Performers

Mutual Funds1W1Y3Y

ABSL Infrastructure5.1%-0.5%-7.2%

IDFC Infrastructure4.6%-4.5%-9.8%

Tata Infrastructure4.5%-0.4%-2.2%

UTI Transportation & Logistics4.5%8.3%-5.1%

Invesco India Infrastructure 4.3%6.7%2.4%

ELSS Tax Saving Funds1W1Y3Y

Axis Long Term Equity3.3%13.2%11.7%

JM Tax Gain2.9%11.8%8.1%

Franklin India Taxshield2.4%3.7%3.3%

IDFC Tax Advantage2.4%11.0%3.4%

Motilal Oswal Long Term Equity 2.3%3.3%4.7%

Stocks (BSE 200)1W1Y5Y

Adani Gas43.5%135.9%NA

Bharti Infratel22.2%-12.6%-8.9%

Bajaj Finserv 21.6%-6.8%32.4%

Adani Green Energy20.4%1080.4%NA

Vodafone Idea 18.2%66.8%-34.6%

Worst Performers

Mutual Funds1W1Y3Y

DSP World Gold-4.7%40.4%17.4%

Invesco India Gold-2.9%29.8%18.1%

Kotak Gold-1.4%30.1%18.9%

Quantum Gold Saving-1.3%29.1%17.9%

Nippon India Gold Saving -1.2%29.5%17.9%

Stocks (BSE 200)1W1Y5Y

Zee Entertainment -6.5%-35.0%-13.0%

REC -4.3%-20.5%8.1%

Reliance Industries -4.1%27.0%34.0%

HUL-3.3%4.1%23.1%

Dr. Reddy’s Laboratories -3.2%70.1%7.9%

Bought and Sold

Bought on kuvera.in1W1Y3Y

Parag Parikh LTE0.6%26.5%14.4%

Axis Mid Cap3.1%19.7%13.9%

Edelweiss Balanced Advantage1.0%16.8%10.3%

Axis Bluechip1.3%13.0%14.1%

DSP Dynamic Asset Allocation 0.8%12.1%9.2%

Sold on kuvera.in1W1Y3Y

ABSL Frontline Equity1.4%6.3%4.9%

HDFC Arbitrage0.1%4.3%5.7%

HDFC Small Cap2.6%8.7%0.3%

L&T Emerging Businesses3.3%6.9%-3.0%

Nippon India Small Cap 3.2%18.6%2.6%

Many Watchlisted

Mutual Fund Watchlist1W1Y3Y

PGIM India Global Equity Opp…3.1%64.6%30.2%

Tata Digital India-0.4%38.1%26.7%

Parag Parikh LTE0.6%26.5%14.4%

IPRU Technology0.6%50.3%26.5%

Mirae Asset Emerging Bluechip 1.5%16.2%9.9%

Stocks Watchlist1W1Y5Y

Reliance Industries-4.1%27.0%34.0%

Adani Green Energy20.4%1080.4%NA

TCS-0.4%26.1%19.0%

Infosys-1.3%59.5%17.8%

HDFC Bank 2.3%7.5%21.5%

US Stocks Watchlist1W1Y5Y

Apple-2.0%78.3%31.5%

Tesla21.7%594.7%61.9%

Amazon-0.6%77.4%35.9%

Microsoft-2.3%40.6%31.2%

Facebook -1.8%36.6%20.2%

Info Source: NSE, BSE & Kuvera.in

Interested in the way we think about the markets?

Read more: Zen And The Art Of Investing

Watch/hear on YouTube:

Start investing via a platform that brings goal investing and planning to your fingertips. Visit kuvera.in to find Direct Plans and Digital Gold and start investing now.

#MutualFundSahiHai, #KuveraSabseSahiHai!

The post Top news and market movers ⚡ this week: 20th Nov’ 20 appeared first on Kuvera.

Article Source and Credit kuvera.in https://kuvera.in/blog/top-news-and-market-movers-%e2%9a%a1-this-week-20th-nov-20/?utm_source=rss&utm_medium=rss&utm_campaign=top-news-and-market-movers-%25e2%259a%25a1-this-week-20th-nov-20 Buy Tickets for every event – Sports, Concerts, Festivals and more buytickets.com

Leave a Reply

You must be logged in to post a comment.