Contrary to what Hollywood would have you believe, trading shares isn’t a matter of picking up a phone, putting in your favorite power lawsuit, and yelling & ldquo;SELL! SELL! SELL! ”

Pictured: Complete BS

Pictured: Complete BS

Rather than trying sell and to buy stocks that are hot from the hopes of hitting it rich, I recommend you reframe: Investing is a longterm solution.

In fact, it’s the one most critical thing you can do to make sure you’re all set for retirement and other savings goals. The earlier you begin, the more easy it is to get rich.

But I get it. We’ve always been led to believe a good deal of things that are unique . Some are positive (“you can get rich by trading stocks! ) ”-RRB-, some of them not so much (“shares are risky, ESPECIALLY with the recession/depression/financial-crisis-of-the-week only round the corner! ”-RRB-.

Luckily, most of that sound is merely that. There’s over 100 decades of evidence in the stock exchange that indicates that by investing in the stock market, you’ll be in a position to increase your wealth consistently with time.

To do that you will have to comprehend the basics of shares and how to trade them.

What is a stock?

Stocks are investments within a business. When you own a stock, you own a part of the business that inventory came out of.

Because of this, since you own a little portion of the business; stocks are referred to as & ldquo; equity, & rdquo.

Stocks vary in price based on how the organization is doing. For example, if Company A just released an amazing new product that is currently selling like mad, the costs of Company A stocks will rise.

If Company A adventures falling sales, their shares are probably going to drop.

Benefits: If your inventory is good and the business is booming, you are able to earn a good deal of money. The currency is liquid. This usually means that you can get it at any time.

Disadvantages: If a firm does badly, so will your inventory. As a inventory isn’t diversified, which could mean catastrophe for you (although you can easily lower your risk by picking larger, solid companies). Also, it’s important to notice that it ’s impossible to game the market — so it’s not really worth trying for the investor.

Those are the basics of what shares are. Let ’s have a look at how you can really trade stocks.

NOTE: You need to only be trading shares when you have the rest of your house in order. That means automating your personal fund system, maxing out your 401k and Roth IRA, and building a emergency finance . You ’ve done that s perfectly fine to spend 5 percent of your income.

What is stock trading?

“Trading” inventory is a tiny misnomer. Is the buying and selling of inventory for money. So you sell or buy your equity, rsquo & this;s considered investing.

And there are two ways you can trade stocks:

Exchange floor trading. Here is the kind of trading that you see with all the people yelling on the floor of the New York Stock Exchange. It’s a tiny complex procedure, but at its core, here’therefore it works: You tell your agent to buy inventory from a business, the agent sends a clerk to the floor to discover a dealer willing to offer the stocks, they agree to a price tag, and you get the stocks.

Forex trading. This can be a procedure of individual investors. It comes in the manner of internet broker platforms that permit you to quickly issue a commerce during trading hours. No longer.

For our intents and purposes, we’re likely to be focused on electronic trading. This ’s how I trade stocks and rsquo & that;s the way the huge majority of individual investors should do it as well. It’s pretty simple, it’s intuitive, and you can Begin in a few simple steps — that brings us to …

The Way to trade stocks

Whenever I’m teaching someone someone will pipe up with issues like:

“What stocks should I purchase? ”

& & ldquo;Is X firm a great investment? ”

& & ldquo;Is $XX a lot with this inventory? ”

First thing’s : SLOW DOWN.

Before Making an investment in any Type of inventory, you’re likely to need to stop and Be Sure you understand how to go about making a determination of what stock to purchase — that brings us to:

Step 1: Set a investment goal

Before you think to begin investing, you need to set some goals.

This is a step psychologically and will help you stay focused on achieving your goals.

A good method to come up with a goal is to ask yourself the reason you’re investing. Would you want to save money ? Are you trying to make money for a purchase ? Do you just want to encourage whatever company/business you’re investing in?

Once you have your why, I suggest framing a SMART goal around it.

Bright goals are the remedy to goal setting which gets you nowhere.

Bright stands for measurable, specific, attainable, relevant, and time-oriented. Listed below are a couple questions you can ask yourself to frame your goal :

Specific. What will my aim attain? What is the precise results I’m looking for?

Measurable. How will I know once I’ve accomplished the goal? What does success look like?

Attainable. Are there any resources I need to get the aim? What are those resources (e.g.gym membership, bank accounts, new clothes, etc.)?

Relevant. So why am I doing this? Do I really WANT to do so? Is it a priority in my life?

Time-oriented. What is the deadline? Will I know in a few weeks if I’m to the ideal track?

When it comes to your stock trading objectives, you may have a goal as simple as ldquo;I want to make $1,000 in my investments in two decades to set up a brand new car” or one which ’s little more complicated like, “I want to make 30 percent more on my chief investment in 1 year. ” See how you are able to set a SMART goal on your investments.

Step 2: Open a brokerage account

An internet broker account is going to be in which you’ll perform your investing and trading — and you’ll find a LOT to select from.

My suggestion: Get a self-serve site like ETrade or TD Ameritrade. Theyrsquo;ll give you a intuitive platform for you started trading shares.

Enrolling is simple. Follow the steps below to open up one now.

This ’s correct. It&rsquo steps within steps! STEPCEPTION.

NOTE: Make sure you have your social security number, employer address, and bank information (account number and routing number) accessible once you join, because theyrsquo;ll come in handy throughout the application procedure.

Step 1: Go to this website for the broker of your choice.

Step 2: Click the ldquo;Open an accountrdquo; switch.

Step 3: Start an application to get an “Individual broker accounts. ”

Step 4: Enter information about yourself name, address employer information.

Step 5: Set an initial deposit by entering your lender information. Some brokers require you to earn so as to deposit money into the brokerage 24, a deposit use another bank accounts.

Step 6: Wait. The initial transfer will occur anywhere from 3 to 7 days to complete. After thatyou&rsquo re ready to make investments.

Step 7: Log in to your brokerage account and begin investing!

The application procedure can be as fast as 15 minutes and will put you in your path to a Rich Life.

Step 3: Buy the initial stock

The simplest approach to narrow down the universe of stock options is to think of businesses you use and prefer.

Just take some time right now to write 15 businesses you return and utilize time after time.

Consider everything. For example:

Food: Whole Foods, Conagra, Shake Shack

Clothing: Under Armour, Limited Brands, Etsy

Services: IBM, UPS

Technology: Apple, Microsoft, Snap

Entertainment: Disney, Live Nation, Netflix

Transportation: Tesla, Ford, CSX Corporation

Rather than 5,000 inventory options at this point you have 15 businesses you could purchase.

Keep in mind that a good firm doesn’t indicate that a stock that is good!

For any inventory, you’re definitely going to want a deeper analysis than “I presume cars from Tesla are dope I&rsquo. ”

You ’re likely to need to Check at five Distinct areas:

Trends: Are sales increasing in this time? Two decades back? 5 decades back?

Products: Is your future bright concerning product development that is upcoming? What news have you ever heard about their future products?

Revenues/profits/growth/earnings per share: The true nuts and bolts of a stockexchange. These are intimidating at first. Many sites will direct you through it.

Direction: Is direction great at the business? Or would they have media like overworking their employees, for practices? What is the turnover? What is their philosophy and capability to execute?

Do as much research as you can. If you see a reason to doubt that a business based on some of the areas above, avert that inventory.

At first each balance sheets, and the charts, sales will probably be unbelievably confusing. It just takes practice.

Your investment future without bullshit

Recall what I mentioned up top: Trading individual stocks is good ONLY IF you have the rest of your house in order.

That implies:

Automating your financing Maxing out your 401k and Roth IRA contributions

Building an emergency fund

Getting out of debt

Those things is it fine to spend 5 percent to 10 percent of your income only when you & rsquo; ve done. This ’s as you don’t get rich from investing in shares. The best method to build a Rich Life is through diversified index funds.

Let’s appearance at a real-world example.

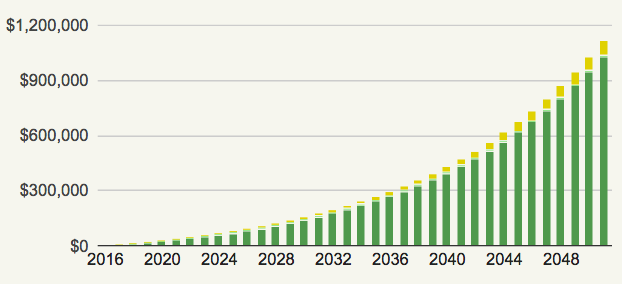

Say you’re 25 years old and you decide to spend $500/month in a cheap index fund. How much money do you think you & rsquo;d have, In the event you do this till you & rsquo; re 60?

Take a look:

$1,116,612.89.

This ’s correct. You’d be a millionaire later investing a few million dollars per year.

Smart investments are all about consistency over simply chasing hot stocks or anything else:

It & rsquo; s awesome that you & rsquo; re moving here if you’re only starting out.

It ’s even important than anything else to begin early. This ’s my group made The Ultimate Guide to Personal Finance.

It’s a thorough manual that’ll introduce you to basic investing theories that’ll greatest place you to get a Rich Life. You & rsquo; ll learn exactly what you will have to do to acquire the financial wins, from mastering your 401k to automating your costs.

Put your name and email below and Irsquo;ll send the manual directly.

How to trade stocks in 3 steps is a post from: I Will Teach You To Be Rich.

Buy Tickets for every event – Sports, Concerts, Festivals and more buytickets.com

Leave a Reply

You must be logged in to post a comment.