The Station is a weekly newsletter dedicated to all things transportation. Sign here just click The Station — to receive it every weekend in your inbox.

Hi friends and new readers, welcome back to The Station, a publication dedicated to all the current and future ways people and bundles move from Point A to Point B.

Before you get to studying The Station, a little update for you. As transportation editor a brand new title I attained previous month — I hope building a team and deepening our policy. My first task was to deliver on Mark Harris, who will be writing investigative pieces in addition to posts for our subscription product Extra Crunch.

His first EC bit, which will release this coming week, is a deep dive into solid-state batteries. This isn’t a one-off. Monthly, EC will publish two “market map” content, which focus on a particular slice of the transportation business, together with other mobility-related analysis. I’m bringing on more terrorists to beef up policy over at TechCrunch. A few of these folks have an expertise in automotive technician and so are helping me revamp the traditional automobile review into something more TechCrunch-y.

Email me in [email protected] to discuss thoughts, criticisms, provide up comments or hints. You might also send an immediate message to me Twitter — @kirstenkorosec.

Micromobbin’

Remember last week when I wondered out loud if a new diversification trend was afoot from the micromobility sector? A rising number of businesses are adding new products for their portfolios or even technological updates. For example, Lime has additional mopeds to its own portfolio and Spin is testing out new three-wheeled scooters that may be remotely operated, via software and people power from Tortoise.

Revel has taken this diversification to some other degree. The shared electric shuttle startup stated it will begin offering monthly electrical bike subscriptions in New York, making this is the second new business venture the company has announced in the previous several weeks.

Until the end of January, Revel was just a shared electrical scooter startup. Then it added a DC fast-charging station for electrical vehicles in New York City. This brand new “Superhub” will comprise 30 chargers and be available to the public 24 hours every day. Revel said it will open other Superhubs across New York City.

A week or so after it announced it was expanding to monthly reservations for electric bikes. The pedal-assist bikes, which are produced by WING Bikes, come equipped with a 36-volt battery that could travel 45 miles on a single charge and can reach speeds of 20 miles per hour.

It doesn’t look — based on comments I received from Revel CEO and co-founder Frank Reig — that the organization is done adding business ventures or product. “Safe to mention this won’t be our last major announcement in 2021,” Reig informed me.

Stay tuned.

Deal of the week

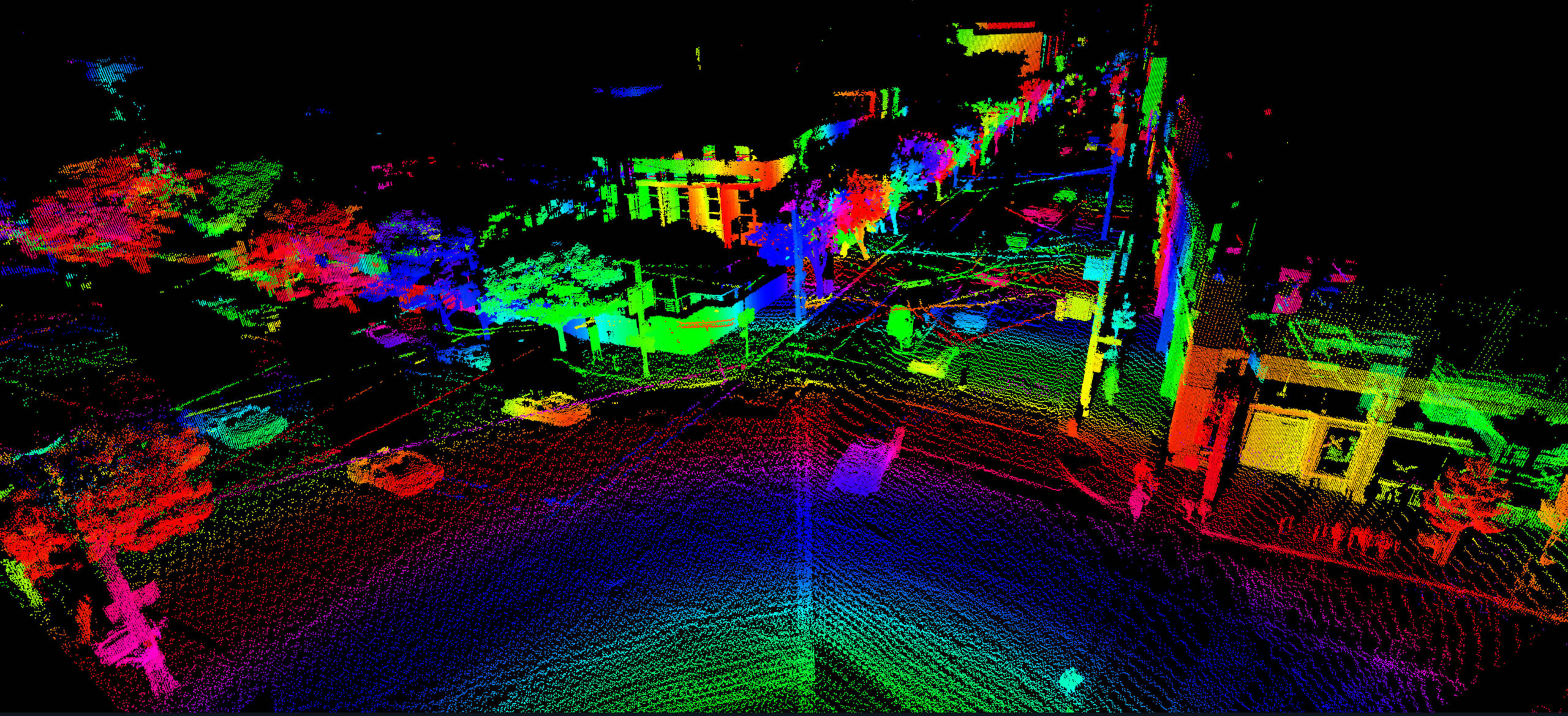

A number of decades ago, I believed that lidar — the light detection and radar that measures distance with laser light to generate an extremely accurate 3D map of this world — had reached its summit. More than 70 lidar startups existed in the time and the timelines around the deployment of autonomous vehiclesthat might unleash massive demand for those sensors, was falling.

Consolidation seemed inevitable. Then came the wave of pivots, when lidar companies used various strategies. Some began to promote their sensors to other industries and others hypothesized the perception software that accompanied the lidar. Many concentrated automakers using the pitch that their sensors could make the advanced driver assistance systems more robust, trustworthy and safe.

A new trend is afoot in lidar land. Merging with SPACs, or special purpose acquisition companies, have come to be a go-to path for companies wanting to access the degree of funds the public market can offer. Lidar companies have joined the party in recent weeks with Aeye getting the latest guest to get there.

Aeye announced that it had been going public by means of a merger together with CF Finance Acquisition Corp.. III that will value the company at $2 billion. Under this AEye said it managed to raise $225 million in private investment in public equity, or PIPE, from strategic and institutional investors that have GM Ventures, Subaru-SBI, Intel Capital, Hella Ventures and Taiwania Capital. Other undisclosed investors participated. Through the transaction, AEye is going to have roughly $455 million in cash on its balance sheet, proceeds that contain $230 million in trust from CF Finance Acquisition Corp.. III, a SPAC sponsored by Cantor Fitzgerald.

Aeye is the sixth lidar company to announce a SPAC because last summer. Velodyne Lidar kicked off the trend as it announced that it intended to go public by means of a merger using special purpose acquisition firm Graf Industrial Corp., using a market value of $1.8 billion. Others soon followed, such as Luminar, Aeva, Ouster and Innoviz.

Which lidar firm will be following?

Other deals that caught my eye this week …

Dingdong Maicai, the Chinese grocery app backed by Sequoia Capital China, is contemplating an initial public offering from the U.S. when this year, Bloomberg reported.

Li-Cycle Corp, also a lithium ion recycler, is close to reaching an arrangement to go public by means of a merger with Peridot Acquisition Corp., Reuters reported. The combined company will have a cost of roughly $1.7 billion.

Metropolis, a brand new parking payment and direction startup based in Los Angeles, has increased $41 million in funding from shareholders, such as real estate managers Starwood and RXR Realty, Dick Costolo and Adam Bain’s 01 Advisors, Dragoneer, former Facebook workers Sam Lessin and Kevin Colleran’s Slow Ventures, Dan Doctoroff, the mind of Alphabet’s Sidewalk Labs initiative; and NBA All Star and early-stage investor, Baron Davis. Global expansion equity company 3L headed the round.

Interesting fact: founder Alex Israel offered his previous company, ParkMe, to Inrix back in 2015.

Recogni Inc., a startup that is developing an AI-powered eyesight recognition module for autonomous vehicles, increased $48.9 million in Series B funding round. Investors contained BMW I Ventures, Toyota AI Ventures, and existing investors, together with Robert Bosch Venture Capital and Continental.

Super73, the direct-to-consumer electrical bike startup, increased $20 million Volition Capital. The Southern California-based firm plans to use the funds to hire more employees, enhance customer service operation and expand its product portfolio, The Verge documented .

Volkswagen is weighing the chance of spinning out its Porsche unit, Bloomberg noted . The company is allegedly meeting with consultants to rate a potential initial public offering or spinoff of the sports car manufacturer.

Volta Energy Technologies, the electricity market and advisory services company, closed on almost $90 million of a targeted $150 million investment fund, according to people familiar with the group’s plans. The enterprise investment vehicle matches a $180 million existing dedication from Volta’s four corporate backers, Equinor, Albermarle, Epsilon and Hanon Systems.

Investor survey 2021

Once per year, I like to reach out to shareholders and ask them a lot of inquiries in a bid to comprehend where they’re placing their funds, identify emerging trends and get a general sense of where the market, and its most sub businesses, are going.

I surveyed 10 investors this time around and printed the results in our subscription product Extra Crunch, where there is going to be a great deal more transportation investigation in 2021. I encourage you to register. Meanwhile, here’s taste of just what a few (maybe not all 10) needed to say when I asked this:

What are the overlooked areas which you would like to invest in, now that legacy automakers are shifting their portfolios to new and electric EV makers are getting ready to begin production?

Clara Brenner, Urban Innovation Fund co-founder/managing spouse: We are extremely curious about the emerging fleet management space — which can be reflected in several of our current investments, such as Electriphi (software to assist fleets transition to electric) and Kyte (activating underutilized fleets to deliver a magic car rental encounter ). There are many efficiencies that come from the fleet version for transportation — we think this is going to be an increasingly significant place in the next few years.

Dave Clark, spouse at Expa: Don’t provide the incumbents too much charge. As technology becomes increasingly commoditized we’ll find new opponents push their way to the market, particularly around new layouts more appropriate to an autonomous and shared system.

A couple specific examples for the readers: EVs are coming price parity with gas-powered cars with the advancements to carbon-neutral/negative-emission tech, energy storage, microgrids and battery life tech. We’re going to determine drone infrastructure and service company models scale because we approach an inflection point in consumer adoption and business regulation.

Ultimately, as autonomous vehicle tech approaches commoditization, there’ll be lots of chances in the application layers that maximize routes and orchestrate tools across supply chains.

Abhijit Ganguly, senior director at Goodyear Ventures: The royal tendency toward electrification presents chances to OEMs, Tier 1 retailers and midsize participants alike. We continue to find opportunities in EV fleet management, aftermarket solutions for enhancing uptime, and reducing cost of operations and encouraging infrastructure development (software and hardware) for easy deployment. Envoy, a Goodyear Ventures portfolio company, is capitalizing on these opportunities through its common freedom EV platform.

Rachel Holt, co-founder/general spouse at Construct CapitalWe invested in a really intriguing company building the software working layer to assist EV hardware manufacturers “connect;” the software layer of EV will be quite an intriguing space.

Sasha Ostojic, Playground Global working partner: There appears to be an overlooked opportunity with consumer automotive apps. We’ve got apps to manage our homes (cameras, speakers, sensors, etc.) so that it ’s just natural that our cars should join that ecosystem. At first it is going to be OEM-specific apps (like the Tesla app or the awful GM program ), but I expect an evolution of available APIs where you can add any automobile for your “garage” (like adding a device to Google Home).

Sebastian Peck, InMotion Ventures’s managing directorI think the market might not have fully appreciated the huge possibility of connected automobile data however, in part because that information is currently still difficult to access for programmers. We see greater OEMs making APIs out there in 2021 and we hope that this will get an extremely lively space with a lot of innovation benefitting consumers and business fleet managers.

Commission on Future Mobility Q&A

The Commission on the Future of Mobility is a brand new global coalition of business, business, policy and technology leaders with a colossal mission. The company recently announced a ton of appointments to its board, notably Mary Nichols, the former seat of the California Air Resources Board and Jim Farley, president and CEO of Ford Motor Co.. Additional commissioners contain, Ola Cabs Chairman Bhavish Aggarwal, Valeo Chairman and CEO Jacques Aschenbroich and Avinash Rugoobur, who is president of Arrival.

I believed that it was time to learn so I achieved and had a conversation with Alisyn Malek, ” the organization’s executive manager and also the former COO and co-founder of May Mobility.

This ’s an edited version of the conversation.

ME: It says here that the ultimate goal of this commission will be to advocate a framework for regulations from the American, European, and Asian markets that reflects and facilitates the technological transformation taking place. That’s a lot.

MALEK: It’s a major goal. (laughs)

ME: Why choose a global approach for this?

MALEK: We think it’s quite important to take a global strategy because that lets you be available to more choices of what solutions could look like. If we were just looking at a particular area — it’s a little bit easier in relation to what you will need to focus on and the problems that you need to fix — but we worried that it would restrict us. By accepting this global strategy, we think that it really creates the opportunity to choose the very best of what everybody is hoping to do and put out those as choices for people to really know what the future may look like.

ME: Will this framework acknowledge that each area has its demographics and demographics and cultural behaviors and infrastructure?

MALEK: We know there’s going to become a one-size-fits-all alternative, so our expectation is to have the ability to gather a compelling vision and make choices that distinct policymakers can select from and understand the trade offs between these.

ME: The CFM highlights that its effects will be based on data methodologies. Can you explain exactly the type of hard data that’s likely to be utilized.

MALEKWe recognize that a lot of work has been done in such spaces before, so we’ll be looking at the present literature and functioning to bring some new info and insight. We do think there are areas where data needs to be collected.

For example, the fluctuations in freight and the growth of e-commerce through the pandemic. Which might be an area where we go in and try to know a new data set. I don’t know that we would be outfitting vehicles to carry that type of data we’ll be looking for for existing data to nourish our studies. That’s an area that is just so new there really isn’will be a whole lot out there now, so I think that’s a place where we might be considerably additive in the data standpoint.

ME: Why does the transportation world need another commission?

MALEK: When we consider every one of the commissions in mobility that exist now — and that there are many — they’re focused on the advocacy of a particular topic or are thinking about performing the study and adding to this knowledge base, however not always carrying that through to advocacy to help drive shift.

A significant part of how the Commission on the Future of Mobility is different is the truth that is bringing together business leaders across the motion of people and goods so we can hash from the hard questions as we perform on our proposals and then bring people to an advocacy stage and help push that shift.

One AI thing

Image Credits: Bryce Durbin

Ultimately, I need to discuss my article about Anthony Levandowski, the prior Google engineer who averted an 18-month prison sentence after receiving a presidential pardon last month.

I learned (and noted ) that Levandowski has formally closed the church he created to comprehend and take a godhead based on artificial intelligence. The church, known as Way of the Future, sparked controversy and interest — similar to Levandowski himself — in the moment it became public in a November 2017 article in Wired.

But as I mentioned in my article, it wasn’t just the creation of this church or its purpose that caused a stir within Silicon Valley and the wider tech industry. The church’s reveal occurred as Levandowski was steeped in a legal dispute with his former employer Google. He had also come to be the central figure of a trade secrets lawsuit between Waymo, the prior Google self-driving project that is now a business under Alphabet, also Uber.

Levandowski piled the church in the end of the year. On the other hand, the process had begun months earlier June 2020, documents filed with the state of California show. The entirety of this church’s capital — just $175,172 — were contributed to the NAACP Legal Defense and Education Fund.

I did talk to Levandowski and while he didn’t get too deep to “why” he closed WOTF, he did state that he believes in its assumption. He considers that artificial intelligence may fundamentally change how people work and live and it can be positive for the society. He mentioned that is not guaranteed. Even without Way of the Future, Levandowski said he’s concentrated on making that happen.

Article Source and Credit feedproxy.google.com http://feedproxy.google.com/~r/Techcrunch/~3/u23Xk-KKhMU/ Buy Tickets for every event – Sports, Concerts, Festivals and more buytickets.com

Leave a Reply

You must be logged in to post a comment.