Freshworks’ $10 billion IPO will go down as a red-letter day in the history of Indian SaaS. After the extravagant NASDAQ listing on September 22, its stock (trading under the ticker symbol ‘FRSH’) has gained swift popularity among Indian retail investors.

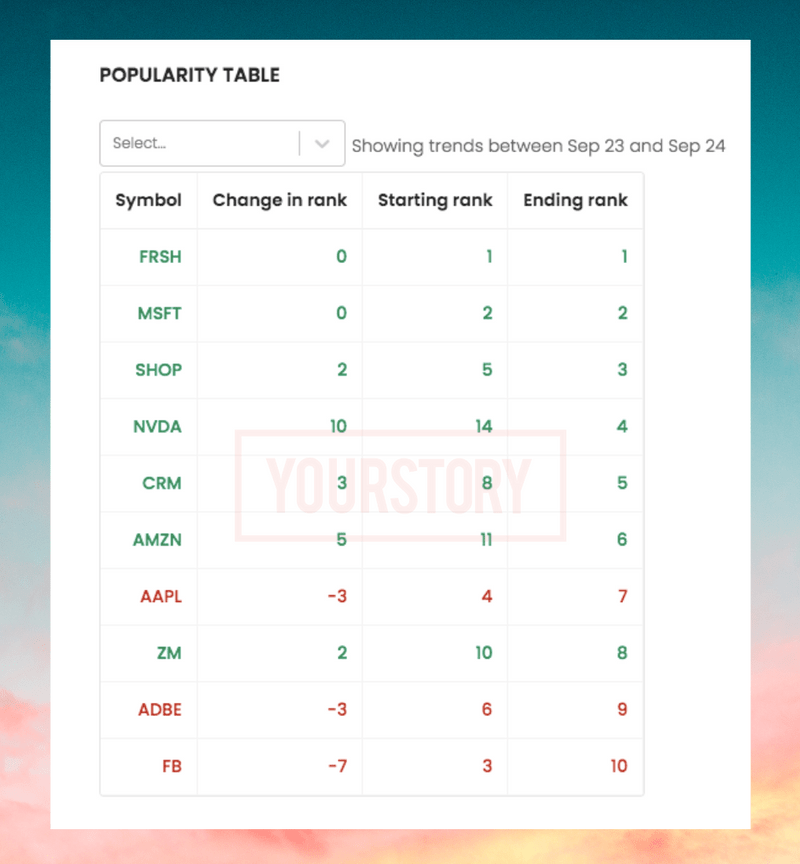

At the close of trade on Friday (September 24), FRSH was already the most bought stock by Indians, as per Vested Finance’s live stock tracker. The US Securities and Exchange Commission (SEC)-registered platform allows Indians to invest in foreign equities, primarily NASDAQ and NYSE stocks.

In data shared exclusively with YourStory, Vested Finance revealed that FRSH has traded more than popular stocks like Microsoft (MSFT), Shopify (SHOP), Salesforce (CRM), Amazon (AMZN), Apple (AAPL), Zoom (ZM), Adobe (ADBE), Facebook (FB), and Tesla (TSLA). More than Rs 2 crore has been invested in FRSH since it got listed.

FRSH has managed to retain its top position on Vested even though its stock price fell by 1.66 percent to $46.75 (from $47.54) at the close of markets on Friday.

Data Source: Vested Finance

ALSO READ

Over 500 Freshworks employees in India turn crorepatis; ‘great sense of fulfilment,’ says CEO Girish Mathrubootham

Viram Shah, Co-founder and CEO, Vested Finance, told YourStory,

“Enquiries were made by Indian investors even before the listing. But unfortunately, they are not allowed to directly invest in IPOs in the US markets. Ever since Freshworks got listed, the trend witnessed is phenomenal. Over the last three days, it has been the #1 stock on our platform. This shows that investors are riding the global wave and investing in big IPO stocks like that of Freshworks.”

“We witnessed a 50 percent spike in daily new account openings on our platform in the last few days due to the Freshworks excitement,” Viram added.

At the time of listing, the Girish Mathrubootham-founded SaaS giant made 10 percent of company stock available for retail buying. The IPO event allowed Freshworks to raise $1.03 billion from the public markets.

“It gives me a great sense of fulfilment today because I feel like this IPO has given me an opportunity as a CEO to fulfil my responsibility to all the employees of Freshworks to date, including those who are ex-employees today, and everyone who has believed in us over the last 10 years and contributed to Freshworks,” Girish told the media.

Given the positive sentiment in the market, with FRSH soaring 30 percent on the opening day, Freshworks’ current valuation is close to $15 billion, as per Forbes estimates. That not only makes it the highest-valued SaaS unicorn from India, but also one of the top three Indian startups by valuation.

YourStory’s flagship startup-tech and leadership conference will return virtually for its 13th edition on October 25-30, 2021. Sign up for updates on TechSparks or to express your interest in partnerships and speaker opportunities here.

For more on TechSparks 2021, click here.

Edited by Saheli Sen Gupta

Article Source and Credit yourstory.com https://yourstory.com/2021/09/exclusive-freshworks-stock-ipo-nasdaq-listing-microsoft-amazon-apple Buy Tickets for every event – Sports, Concerts, Festivals and more buytickets.com

Leave a Reply

You must be logged in to post a comment.