Jake Bright

Contributor

Jake Bright is a writer and Writer in New York City.

He is co-author of The Next Africa.

More articles by this contributor

Polestar unveils first Manufacturing EV with aim to overtake Tesla

Liquid Telecom goes on Africa’s startups as future clients

Nigerian digital payments startup Paga is gearing up to get international growth with a $10 million round led by the Global Innovation Fund.

The company is exploring the release of its payments product in Ethiopia, Mexico, and the Philippines–CEO Tayo Oviosu informed TechCrunch.

Paga appears to really go head to head with regional and worldwide payment players, including as PayPal, Alipay, and Safaricom based on Oviosu.

“We aren’t just in a position to compete together we’re going beyond them,” he also explained of Kenya’s MPesa cellular cash product. “Our objective is to create a payment ecosystem across several markets that are emerging. ”

Founded in 2012, Paga has made platform and a network to transport money, pay debts, and buy things digitally 9 million customers in Nigeria–such as 6000 companies.

Since beginning, the startup has recently dropped 57 million trades worth $3.6 billion, based on Oviosu. He combined Cellulant CEO Ken Njoroge and Helios Investment Partners’ Fope Adelowo at Disrupt San Francisco to talk fintech along with Africa’s tech ecosystem.

South African fintech startup Jumo increased a $52 million round (headed by Goldman Sachs) to deliver its fintech solutions to Asia. The organization –which offers loans to the unbanked in Africa–has opened an office in Singapore to lead the way.

The new round accepts Jumo to $90 million raised by investors and saw participation from present backers which have Proparco — which is connected to the French Development Agency — Finnfund, Vostok Emerging Finance, Gemcorp Capital, along with LeapFrog Investments.

Founded in 2014, Jumo specializes in societal impact goods. That means loans and saving options for people who sit outside of the banking system, and particularly small companies.

Thus far, it claims to have aided nine million customers throughout the six markets in Africa and originated around $700 million in securities. The organization, which has some 350 staff across 10 offices in Africa, Europe and Asia, has been a part of Google’s Launchpad accelerator last calendar year. Jumo is directed by CEO Andrew Watkins-Ball, who has close to 2 decades in finance and investing.

Lagos based Paystack increased a $8 million Series A round led by Stripe.

In Nigeria rsquo & the organization;s payment API integrates with thousands of companies, and in two years it’s grown to process 15 percent of online payments.

In 2016, Paystack became the very first startup out of Nigeria to enter Y Combinator, along with the incubator is performing a few follow-on investing in this round.

Other investors in this Series A include Visa and also the Chinese online giant Tencent, parent of WeChat along with a plethora of other services. Tencent additionally spent in Paystack’s round: the startup has raised $10 million.

Paystack integrates a vast assortment of payment choices (cable transfers( cards, and cellular ) which Nigerians (and shortly, people in other countries in Africa) utilize both to accept and make payments. There’s even more about the company’s platform and strategy in this TechCrunch feature.

South African startup Yoco increased $16 million in a new round of financing to expand its payment management and audit solutions for small and medium-sized businesses as it angles to become one of Africa’s billion-dollar firms.

South African startup Yoco increased $16 million in a new round of financing to expand its payment management and audit solutions for small and medium-sized businesses as it angles to become one of Africa’s billion-dollar firms.

To get there the company that “builds services and tools to assist SMEs get paid and handle their organization ” intends to exploit $20 billion in commercial action the company’s co-founder and chief executive order, Katlego Maphai estimates will move out of cash payments to digital offerings.

Yoco provides a point of sale card reader which connects with an entry cost of over $100.

With this kit, cash-based companies can start accepting cards and tracking metrics such as goods , peak sales periods, and inventory flows.

Yoco has set itself as a lost link to ldquo;resolving an access issue ” for SMEs. Though South Africa has POS and company enterprise suppliers — and relatively substantial card (75 percent) and mobile penetration (68 per cent ) — the organization estimates just 7% of South African companies accept cards.

Yoco says it is processing $280 million in annualized fee quantity for under 30,000 companies.

The startup generates revenue through earnings on hardware and software sales and fees of 2.95 percent per transaction on its own POS apparatus.

Yoco will utilize the $16 million around product and platform development, developing its distribution channels, and acquiring new gift.

Emerging markets credit startup Mines.io closed a $13 million Series A round led by The Rise Fund, and looks to expand in South America and Asia.

Mines provides business to customer (B2C) “credit-as-a-service” goods to large firms.

“We& & rsquo;re a tech company that facilitates neighborhood institutions — banks, mobile operators, mobile operators, merchants — to offer credit to their customers,” Mines CEO and co-founder Ekechi Nwokah told TechCrunch.

Most of Mines’ partnerships demand white-label financing products such as non-smart USSD apparatus.

With offices in San Mateo and Lagos, Mines utilizes big-data (extracted chiefly from cellular users) and proprietary threat calculations “to allow lending decisions,” Nwokah clarified.

Mines began operations in Nigeria and counts payment processor Interswitch and cellular operator Airtel as current partners. In addition to talent acquisition, the startup plans to utilize the Series A to expand its own goods into new markets in South America and Southeast Asia “in the next few weeks,” according to its CEO.

Nwokah wouldn’t name countries for the startup’s pending South America and Southeast Asia growth, but believes &ldquo. ”

As part of this Series A, Yemi Lalude out of TPG Growth (founder of The Rise Fund) will join Mines’ board of supervisors.

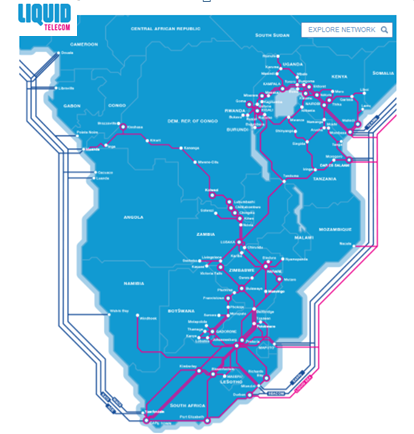

Digital infrastructure firm Liquid Telecom is gambling big on African startups by rolling out multiple sponsorships and absolutely free internet across key access points to the continent’s tech entrepreneurs.

The Econet Wireless subsidiary can be partnering with local and global players such as Afrilabs and also Microsoft to create a cross-border commercial community for the country ’s startup community.

“We believe startups will be companies in Africa’s potential market. Theyrsquo;re additionally our future customers,” Liquid Telecom’s Head of Innovation Partnerships Oswald Jumira told TechCrunch.

With 13 offices around the continent, Liquid Telecom’s core business is creating the infrastructure to get many things digital in Africa.

The company provides voice, high-speed internet, and IP services at enterprise the carrier, and also level across Eastern, Central, and Southern Africa. It operates data centers in Nairobi and Johannesburg with 6,800 square metres of stand space.

Liquid Telecom has assembled a 50,000 kilometer fiber system, from Cape Town to Nairobi and this year switched about the Cape to Cairo initiative–a land-based fiber link in South Africa to Egypt.

The organization is betting they will as enterprise customers, Even though startups don & rsquo; t supply an immediate sales windfall.

“Step one…in encouraging startups has beenhellip;.supporting co-working spaces and events with sponsorships and internet,” Liquid Telecom CTO Ben Roberts told TechCrunch. “Step two is assisting startups to embrace …company services. ”

Liquid Telecom supplies free internet to 30 hubs in seven countries and is active sponsoring startup associated occasions .

For startups, it & rsquo; s growing commercial solutions on the infrastructure side to plug into.

“At the early stage and middle stage, we’re offering startups connectivity, skills improvement, and access to capital through the hearts,” stated Liquid Telecom’s Oswald Jumira.

“When they reach the mature level, rsquo & we;re be a move to advertise partner for them; and also focused on how we could scale them up & hellip. To do theyrsquo;ll should leverage…cloud hosting solutions. ”

Microsoft and Liquid Telecom announced a partnership in 2017 to offer cloud services like Microsoft’s Azure, Dynamics 365, and Office 365 to choose startups through free credits–also connected to comp bundles of Liquid Telecom product supplies.

On the venture side, Liquid Telecom doesn’t possess a finance but that may be in the cards.

“We harbor ’t yet started investing in startups, however I’d prefer to see we perform,” stated chief tech officer Ben Roberts. “That may be the next move onwards… by having business partnerships. ”

And lastly, tickets are now accessible here to Startup Battlefield Africa in Lagos this December. The first two speakers were announced, TLcom Capital senior partner and former minister of communication technology for Nigeria Omobola Johnson along with Singularity Investment’s Lexi Novitske will discuss keys to investing over Africa’s startup landscape.

More Africa Related Stories @TechCrunch

African Experiments With Drone Technologies Could Leapfrog Decades of Infrastructure Neglect

Fibre Wants to Make It Easier to Invest in Real Estate in Africa

Expanding its Internet Service to More Countries in Africa, Tizeti raises $3 million

Facebook Expands Its Express Wi-Fi Program for Developing Markets via Hardware Partnerships

African Tech Around the Net

Naspers’ OLX Invests $94 Million in South Africa’s Webuycars

Alibaba’s Jack Ma establishes $10m Netpreneur Prize for African entrepreneurs

Sub-Saharan Africa to Hit 634 Million Unique Mobile Subscribers by 2025

MEST Invests $700k in 7 African Tech Startups

Hello Tractor, John Deere Partner to Deploy 10,000 Tractors Across Nigeria

Blockchain Startup Wala Wins 2018 Zambezi Prize for Innovation in Financial Inclusion

Buy Tickets for every event – Sports, Concerts, Festivals and more buytickets.com

Leave a Reply

You must be logged in to post a comment.