Top news

Foreign Portfolio Investors (FPIs) invested Rs 1.42 lakh crore into equities during October – December quarter compared to Rs 51,984 crore during the previous quarter.

The net AUM of mutual funds grew by 7.6% to Rs 29.71 lakh crore in December 2020 compared to the AUM of Rs 27.6 lakh crore at the end of September quarter.

Net outflows from open ended equity mutual funds stood at Rs 10,147 crore in December 2020 compared to outflow of Rs 12,917 crore in the previous month.

HDFC Equity Fund and DSP Equity Fund are being renamed and reclassified to ‘HDFC Flexicap Fund’ and ‘DSP Flexi Cap Fund’ with effect from 28 January and 29 January respectively.

jQuery(document).ready(function() {

jQuery(‘#sample_slider’).owlCarousel({

items : 1,

smartSpeed : 500,

autoplay : true,

autoplayTimeout : 3500,

autoplayHoverPause : true,

smartSpeed : 500,

fluidSpeed : 500,

autoplaySpeed : 500,

navSpeed : 500,

dotsSpeed : 500,

loop : true,

nav : true,

navText : [”,”],

dots : true,

responsiveRefreshRate : 200,

slideBy : 1,

mergeFit : true,

autoHeight : true,

mouseDrag : true,

touchDrag : true

});

jQuery(‘#sample_slider’).css(‘visibility’, ‘visible’);

sa_resize_sample_slider();

window.addEventListener(‘resize’, sa_resize_sample_slider);

function sa_resize_sample_slider() {

var min_height = ’20’;

var win_width = jQuery(window).width();

var slider_width = jQuery(‘#sample_slider’).width();

if (win_width < 480) {

var slide_width = slider_width / 1;

} else if (win_width < 768) {

var slide_width = slider_width / 1;

} else if (win_width < 980) {

var slide_width = slider_width / 1;

} else if (win_width < 1200) {

var slide_width = slider_width / 1;

} else if (win_width < 1500) {

var slide_width = slider_width / 1;

} else {

var slide_width = slider_width / 1;

}

slide_width = Math.round(slide_width);

var slide_height = '0';

if (min_height == 'aspect43') {

slide_height = (slide_width / 4) * 3; slide_height = Math.round(slide_height);

} else if (min_height == 'aspect169') {

slide_height = (slide_width / 16) * 9; slide_height = Math.round(slide_height);

} else {

slide_height = (slide_width / 100) * min_height; slide_height = Math.round(slide_height);

}

jQuery('#sample_slider .owl-item .sa_hover_container').css('min-height', slide_height+'px');

}

var owl_goto = jQuery('#sample_slider');

jQuery('.sample_slider_goto1').click(function(event){

owl_goto.trigger('to.owl.carousel', 0);

});

jQuery('.sample_slider_goto2').click(function(event){

owl_goto.trigger('to.owl.carousel', 1);

});

jQuery('.sample_slider_goto3').click(function(event){

owl_goto.trigger('to.owl.carousel', 2);

});

jQuery('.sample_slider_goto4').click(function(event){

owl_goto.trigger('to.owl.carousel', 3);

});

var resize_6799 = jQuery('.owl-carousel');

resize_6799.on('initialized.owl.carousel', function(e) {

window.dispatchEvent(new Event('resize'));

});

});

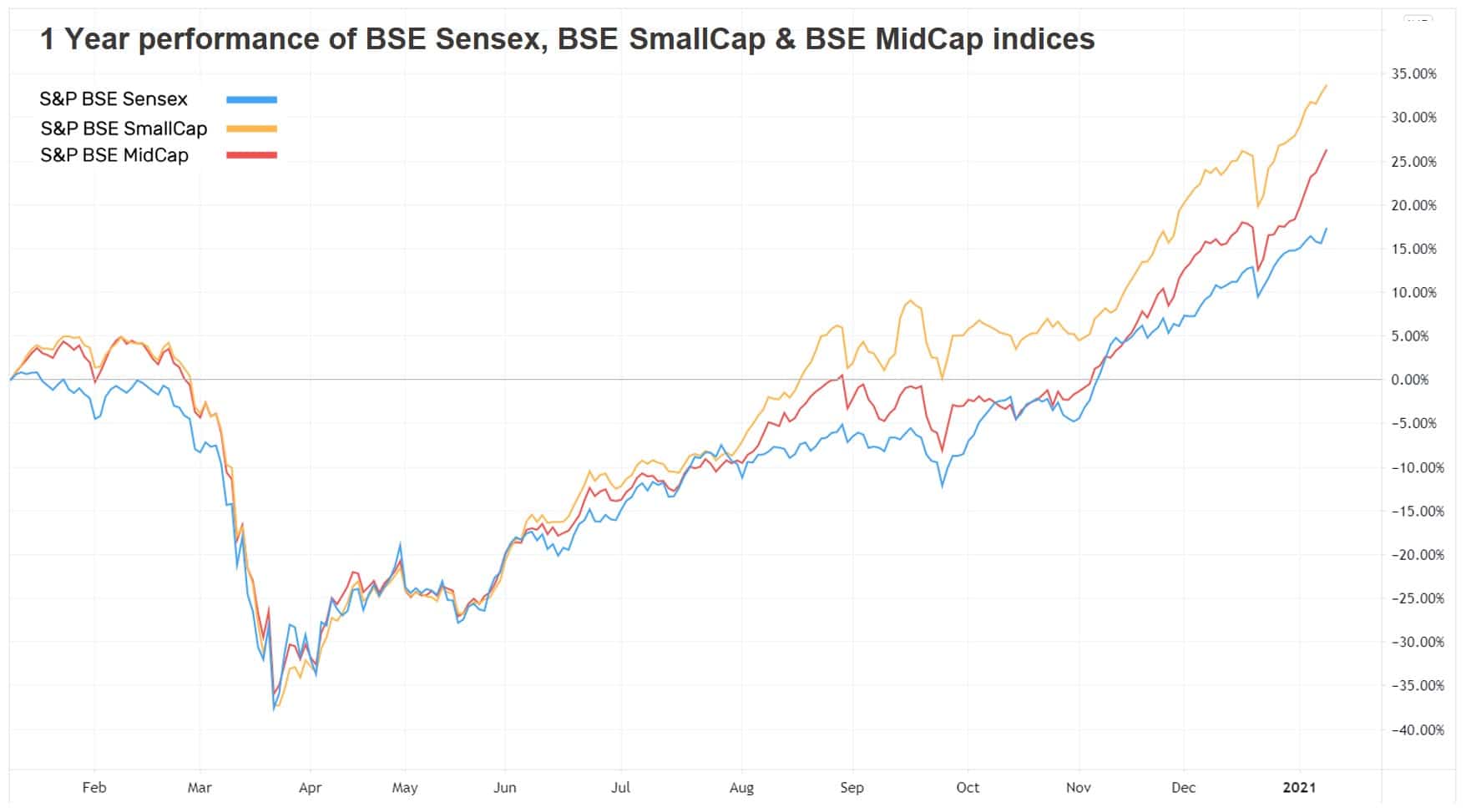

Index Returns

Index1W1Y3YP/EP/B

NIFTY 502.3%19.2%10.5%39.54.1

NIFTY NEXT 504.8%22.0%2.4%43.84.6

S&P BSE SENSEX1.9%19.4%12.4%33.93.3

S&P BSE SmallCap3.5%36.1%-1.7%NA2.6

S&P BSE MidCap5.4%28.5%1.6%70.22.9

NASDAQ 1001.7%46.8%25.2%40.48.7

S&P 5001.8%17.5%11.6%30.54.6

Best Performers

Mutual Funds1W1Y3Y

DSP World Mining9.6%49.5%17.4%

DSP Natural Resources & Ne..8.8%23.8%2.9%

DSP World Energy7.4%6.0%3.8%

Edelweiss Mid Cap6.0%38.2%6.9%

L&T Infrastructure 5.9%8.5%-4.7%

ELSS Tax Saving Funds1W1Y3Y

Quantum Tax Saving5.2%21.5%5.7%

Quant Tax4.7%59.5%15.9%

Franklin India Taxshield4.5%18.0%6.3%

Essel Long Term Advantage4.5%16.9%6.6%

Baroda Elss 96 B 4.3%25.2%4.1%

Stocks (Top 200 by market cap)1W1Y5Y

Hindustan Zinc 27.2%42.5%22.0%

Shriram Transport23.8%18.7%8.0%

LIC Housing Finance 22.4%5.4%-0.7%

Polycab 20.4%29.9%NA

IDFC First Bank 19.8%2.1%-5.7%

Worst Performers

Mutual Funds1W1Y3Y

PGIM India Global Equity Opp…-3.0%64.6%30.8%

HSBC Brazil-1.4%-23.0%0.1%

Principal Retirement Saving Pro…-0.6%11.5%4.1%

Principal Retirement Saving Mod…-0.4%10.0%4.5%

ABSL Gold -0.3%20.6%17.1%

Stocks (Top 200 by market cap)1W1Y5Y

Syngene International-5.7%95.0%24.8%

Gujarat State Petronet -5.2%-11.0%9.1%

Whirlpool Of India 5.2%10.8%30.5%

Bajaj Finance 4.0%26.8%52.5%

ITC 3.6%-14.3%2.4%

Bought and Sold

Bought on kuvera.in1W1Y3Y

Parag Parikh LTE0.9%34.7%15.4%

UTI Nifty Index2.3%20.0%11.60%

Axis Bluechip1.9%25.4%16.9%

Axis Long Term Equity2.8%26.6%14.2%

Motilal Oswal Nasdaq 100 FOF 0.5%51.4%NA

Sold on kuvera.in1W1Y3Y

ABSL Index2.3%19.8%11.0%

HDFC Small Cap3.3%25.1%1.4%

L&T Emerging Businesses4.3%21.9%-1.5%

Franklin India Smaller Comp..3.9%25.0%-0.4%

ABSL Frontline Equity 3.0%20.3%7.6%

Most Watchlisted

Mutual Fund Watchlist1W1Y3Y

PGIM India Global Equity Opp..-3.0%64.6%30.8%

Tata Digital India5.0%64.0%31.7%

Parag Parikh LTE0.9%34.7%15.4%

Axis Bluechip1.9%25.4%16.9%

IPRU Technology4.5%80.6%30.6%

Stocks Watchlist1W1Y5Y

Reliance Industries-2.6%28.0%30.6%

Adani Green Energy-3.6%382.8%NA

Infosys4.5%80.3%20.8%

Tata Consultancy Services9.0%41.5%22.2%

HDFC Bank -0.3%13.6%22.1%

US Stocks Watchlist1W1Y5Y

Tesla24.7%814.3%83.6%

Apple-0.5%70.5%40.3%

NIO20.9%1602.9%NA

Amazon -2.3%67.5%39.3%

Microsoft -1.3%35.5%33.2%

Data Source: NSE, BSE & Kuvera.in

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch/hear on YouTube:

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and Digital Gold and start investing today.

#MutualFundSahiHai, #KuveraSabseSahiHai!

The post Top news and market movers ⚡ this week: 8th Jan’ 21 appeared first on Kuvera.

Article Source and Credit kuvera.in https://kuvera.in/blog/top-news-and-market-movers-%e2%9a%a1-this-week-8th-jan-21/?utm_source=rss&utm_medium=rss&utm_campaign=top-news-and-market-movers-%25e2%259a%25a1-this-week-8th-jan-21 Buy Tickets for every event – Sports, Concerts, Festivals and more buytickets.com

Leave a Reply

You must be logged in to post a comment.